To manage money intelligently, you don't need high-risk investments or thousands of dollars in the bank. Regardless of your current financial situation, you can learn how to make better use of money in daily life. Start by creating a budget that helps you stay on track and prioritize your financial goals. Then, you can try to pay off your debts, accumulate savings and spend your money better.

Steps

Method 1 of 4: Manage Your Budget

Step 1. Set yourself financial goals

Having a milestone to reach will help you create a budget that fits your needs. Do you want to pay off your debts? Do you have to save to make a major purchase? Are you just looking for greater financial stability? Clearly set your priorities so you can create a budget that takes them into account.

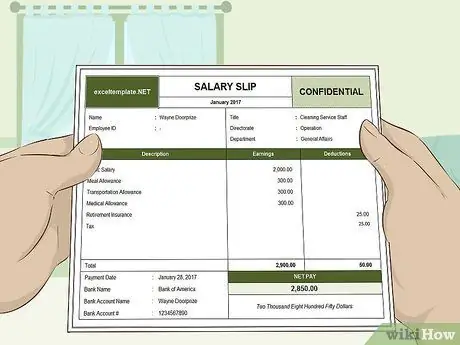

Step 2. Consider your total monthly income

A smart budget doesn't allow you to spend more than you earn. Start by calculating your total monthly revenue. Don't just include the salary you get at work, but also any extra income, such as chores or alimony. If you share the expenses with your partner, calculate the combined income to budget for the whole family.

You should try not to exceed the revenues with the expenses. Emergencies and unforeseen events happen, but try not to use credit cards to buy non-essential items when your bills are running out

Step 3. Calculate the necessary expenses

The first priority to create a better budget is to enter the mandatory monthly expenses. Covering these costs should be your first thought, because these are not only expenses necessary for everyday life, but they can also ruin your credit if you don't pay them on time and in full.

- These expenses include mortgages and rentals, utility bills, car payments and credit card payments, as well as fixed expenses such as food, fuel and insurance.

- Authorize automatic bill payments from your bank account, so they always have priority. With this method, the money will be withdrawn directly from your account on the due date.

Step 4. Consider unnecessary expenses

To work, your budget must reflect your daily life. Analyze the expenses that you incur on a regular basis but are not essential and put them in your budget, in order to predict the total expenses. For example, if you have coffee at the café every morning, add it to your budget.

Step 5. Try to make cuts

Creating a budget will help you identify areas where you can spend less, increasing your willingness to save or pay off debt. For example, investing in a good coffee pot and a quality thermos can help you save a lot of money in the long run without giving up your morning coffee.

Don't just consider your daily expenses. Check your insurance policy and see if you can make any cuts. For example, if you have comprehensive fire and theft insurance for your cheap old car, you may want to cover third party damage only

Step 6. Make a note of your monthly expenses

A budget is a guide to your overall spending habits. Actual releases vary each month based on personal needs. Record what you spend in a journal, spreadsheet, or even a savings app to make sure you don't exceed your monthly budget.

If you accidentally go over your budget, don't beat yourself up. Use the opportunity to consider whether you need to include other expenses. Remember that forecasts are never perfect and that with commitment you will be able to reach your financial goals

Step 7. Make a savings quota in your budget

The amount to set aside varies based on your job, your expenses, and your personal financial goals. You should try to save some money every month, be it € 50 or € 500. Keep that money in a savings account, separate from your main checking account.

- These savings should be separate from your retirement fund or other investments you have. Setting aside a general savings fund will help protect you from emergencies, such as expensive home repairs or sudden layoffs.

- Many finance experts recommend setting aside what is needed to cover at least 3-6 months of expenses. If you have a lot of debt to pay off, try to create a partial emergency fund of one or two months, then spend the rest of the money to cover the debts.

Method 2 of 4: Settle the Debts

Step 1. Calculate the amount due

To understand how to best pay off your debts, you must first understand how much they are. Add up all your debts, including short-term loans, credit card payments, mortgages, and loans in your name. Observe the result, so that you have a clear idea of how long you need to reenter and how long it will take you realistically.

Step 2. Prioritize High Interest Debts

Debts such as those with credit cards often have higher interest rates than first home loans. The longer you hold onto a high-interest debt, the more you'll be forced to pay. Worry first about the heaviest debts, reserving only the minimum installment for the less urgent ones.

If you have taken out a short-term loan, for example to buy a car, pay it back as soon as possible. These loans can wreak havoc on your finances if you don't pay them off in full by the due date

Step 3. Once you've paid off one debt, go straight to the next

When you come back from debt with a credit card, don't start using that portion of your monthly income for ordinary expenses again. Instead, start paying off the next debt.

For example, if you've finished paying off your debt with a credit card, add that amount to your home loan minimum payment from next month

Method 3 of 4: Set aside your savings

Step 1. Set yourself a savings goal

It's easier to save money when you know what you'll be spending it on. Try to set a goal, such as creating an emergency fund, saving for an advance, buying an expensive home item, or setting up a pension fund. If your bank allows it, you can even give your account a custom name, such as "Holiday Fund" to remember what you want to achieve.

Step 2. Keep your savings in a separate account

You can usually do this in a deposit account to start with. If you already have a solid emergency fund and have a reasonable amount of money to invest, for example € 1,000, you can consider a CD, a security that represents a time deposit. Since you won't be able to access your money easily, these securities usually have much higher interest rates than regular accounts.

- Keeping your savings separate from your checking account makes it harder to squander them. Deposit accounts also often have higher interest rates than checking accounts.

- Many banks allow you to set up automatic transfers from your checking account to your deposit account. Set up a monthly transfer, even if for a small amount.

Step 3. Invest in raises and bonuses

If you get a raise, bonus, tax refund, or other unexpected income, put it in your savings. This is an easy way to increase your capital without changing your budget.

If you get a raise, pay the difference between the salary you budgeted for and the new salary directly into your savings. Since you already have a program that allows you to live off the salary you previously earned, you can use the extra money that comes in each month to accumulate savings

Step 4. Transfer the money you get from secondary jobs into your savings

If you happen to make money from other jobs, budget only on the basis of your primary source of income and dedicate all the rest of your earnings to savings. This will help you increase the amount of capital you have aside more quickly and make your budget more comfortable.

Method 4 of 4: Spend Money Wisely

Step 1. Consider what your priorities are

Start each period by setting aside money for basic necessities. In that fee, you must include mortgages, utility bills, insurance, fuel, food, recurring medical bills, and other fixed costs. Do not allocate money to non-essential expenses until you have paid all the necessary ones.

Step 2. Compare prices

It's easy to get into the habit of always shopping at the same store, but spending some time researching can help you find the best prices. Check in stores and on the internet to find the best deals. Look for stores that sell, those that specialize in discounted goods or surpluses.

In stores that sell wholesalers, you can buy items you use often, or things that don't expire, such as cleaning supplies

Step 3. Buy off-season shoes and clothes

New styles of clothes, footwear and accessories are usually produced every season. Buying out of season items will find you better deals. Online shopping is the best way to find similar items, which are often not kept in store warehouses.

Step 4. Pay in cash and not by card

Allocate a share of the budget for unnecessary expenses, such as dining out or going to the movies. Withdraw the necessary amount before going out and leave your credit card at home. This way you will avoid overspending or impulsively buying something when you are out.

Step 5. Check your expenses

In the end, if you don't spend more than you earn, you stick to your budget. Regularly keep track of your expenses in any way you like. You could check your bank account every day, or use an app, like Mint, Dollarbird, or Billguard, that helps you keep track of your spending.