This guide explains how to calculate the Net Present Value (NPV) of an investment using Microsoft Excel. You can do this on both the Windows version of the program and the Mac version.

Steps

Step 1. Make sure you have the necessary investment information available

To calculate the NPV, you need to know the annual discount rate (e.g. 1%), the initial invested capital and at least one year of return on investment.

The ideal would be to have three or more years of return on investment, but it is not necessary

Step 2. Start Microsoft Excel

The app icon looks like a green square with a white "X".

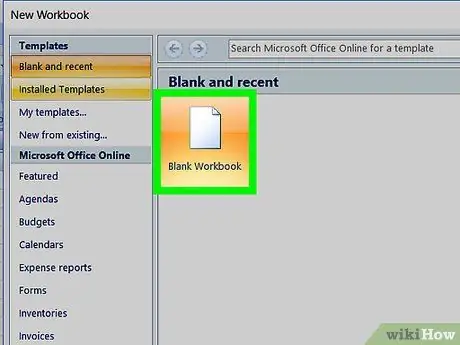

Step 3. Click on New Workbook

You will see this button at the top left of the Excel window.

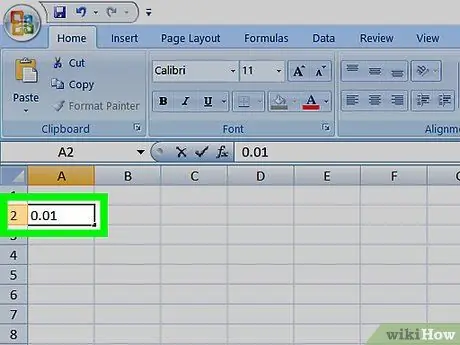

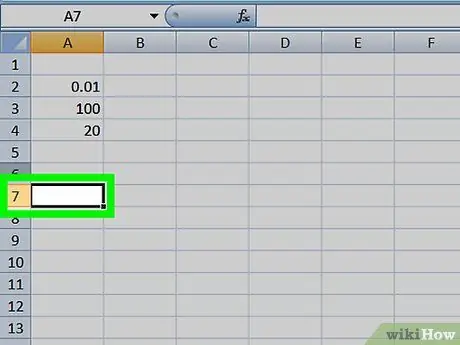

Step 4. Enter the discount rate for your investment

Select a cell (e.g. A2), then enter the decimal equivalent of the annual discount rate as a percentage of your investment.

For example, if the discount rate is 1%, enter 0.01

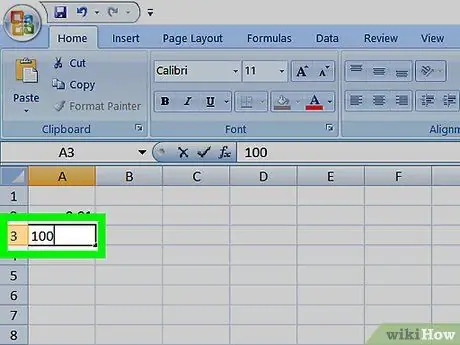

Step 5. Enter the initial invested capital

Select an empty cell (e.g. A3) and type in the amount you initially invested.

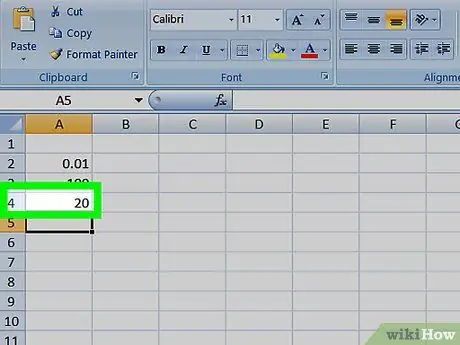

Step 6. Enter the return value for each year

Select an empty cell (ex: A4), type the first year return and repeat for all the years for which you have return information.

Step 7. Select a cell

Click on the cell where you want to calculate the NPV.

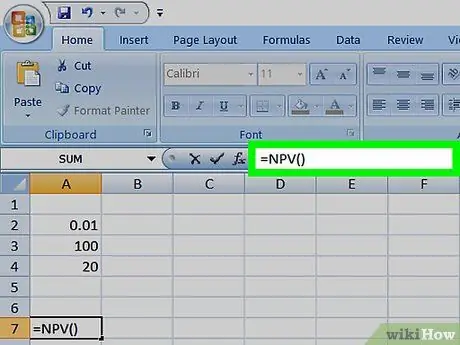

Step 8. Enter the first part of the NPV formula

Type in the cell = VAN (). You will need to put the investment data in parentheses.

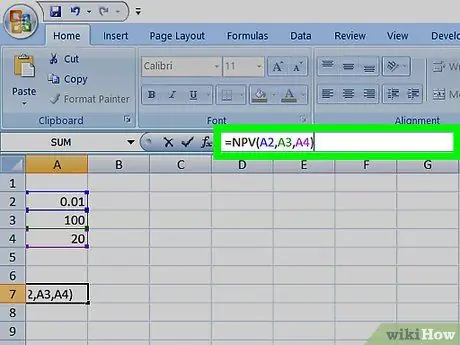

Step 9. Add the values to the NPV formula

Inside the brackets, you need to add the cell numbers that contain the discount rate, invested capital, and at least one annual return.

For example, if the discount rate is in the cell A2, the capital invested in A3 and the return of the first year in A4, the formula becomes = NPV (A2, A3, A4).

Step 10. Press Enter

Excel will calculate the NPV and show it in the cell you selected.