The term "cumulative growth rate" is used to describe the increase over a given period as a percentage. It is used to measure past growth, make plans based on projected population growth, estimate cell development, quantify sales growth, and so on. It is a useful descriptive tool that helps to understand how growth has developed over time or how it will continue to evolve. Investors, financial market experts and business executives must know how to calculate this percentage, which is often referred to by the English acronym CAGR (cumulative average growth rate), because it is mentioned many times in the financial sections. of the annual income statements of the companies. This article describes several ways to find and use the CAGR.

Steps

Method 1 of 3: Manual Calculation

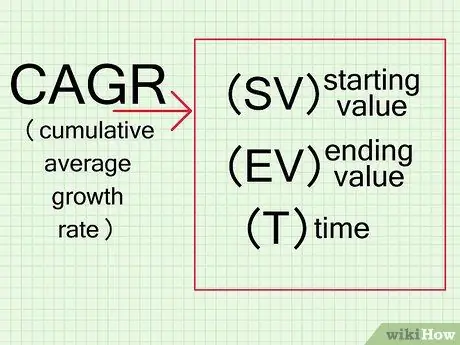

Step 1. Identify the data you need for the calculation

To get the percentage value, you need some essential information: the starting data, the final one and the time period for which growth is considered.

- Identify the starting value (SV) of an asset; for example, the price paid for a stock.

- Find the final (EV), or current, market value of the asset under consideration.

- Determine the time period (T) you want to study - the number of years, months, quarters, and so on.

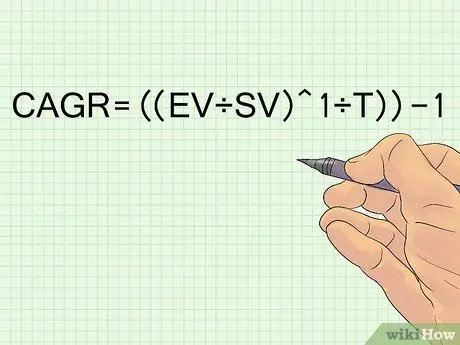

Step 2. Transfer the numerical information into the formula

Once you've got all the data you need, put it into the equation for the CAGR: CAGR = ((EV / SV) ^ 1 / T)) -1.

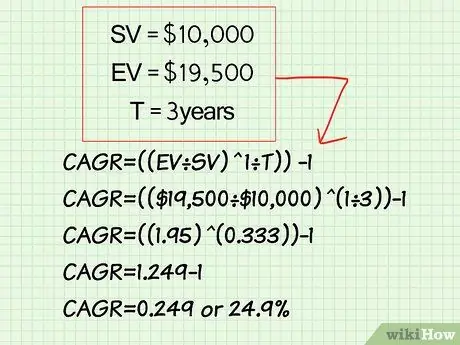

Step 3. Solve the formula

After replacing the variables with the known data, solve the equation respecting the order of operations. This means that you must first find the value of 1 / T, since it is an exponent, then calculate EV / SV and raise it to the power of the number you found earlier and finally subtract 1 from the result. The final value corresponds to the growth rate.

For example, if an investment portfolio had an initial value of € 10,000 that grew to € 19,500 in three years, the formula is: CAGR = ((€ 19,500 / € 10,000) ^ (1/3)) - 1 which simplified it becomes CAGR = ((1, 95) ^ (0, 333)) - 1 i.e. CAGR = 1, 249-1. The CAGR value is equal to 0, 249 that is 24, 9%

Method 2 of 3: Calculate the CAGR with a Computer

Step 1. Use an online calculator

Perhaps the simplest method to derive the CAGR value is to use an automatic online system that allows you to enter data corresponding to SV, EV and T and then does all the calculations for you. To find this type of calculator, just enter the keywords "CAGR calculator" into a search engine.

Step 2. Use Microsoft Excel

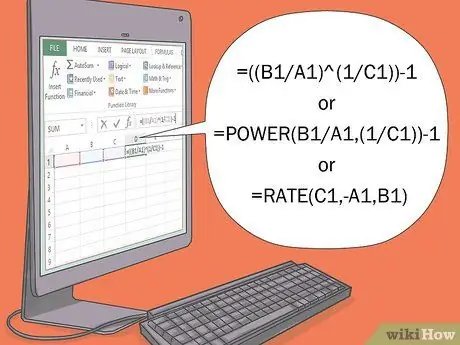

This is a valid alternative; you can also use other spreadsheets, but the structure of the formula you enter may be different. If so, follow the instructions specific to the program you have chosen. Start entering the known values (SV, EV and T) in the cells of the spreadsheet; for example, it reports SV in cell A1, EV in B1, and T in C1.

- The simplest way to calculate the cumulative growth rate with Excel is to write the formula down in the fourth cell; in the example considered, you have to type the equation in cell D1: = ((B1 / A1) ^ (1 / C1)) - 1. The program performs the calculations and displays the result in the cell you have chosen for the formula.

- Alternatively, you can take advantage of the "POWER" function which calculates the equation using exponents; in that case, you have to type: = POWER (B1 / A1, (1 / C1)) - 1. Also in this other context, the solution appears in the cell you chose after pressing the "Enter" key.

- Excel is able to calculate the CAGR using the "RATE" function. Insert it in a new cell by typing this command: = RATE (C1, -A1, B1), press the "Enter" key and the result will appear.

Method 3 of 3: Using CAGR to Predict Cumulative Growth

Step 1. Identify the values you need to calculate the CAGR

This mathematical tool also allows you to predict future growth based on previous values. Proceed in a similar way to calculating the CAGR; you need the initial value, the growth rate and the reference period, while the final (or future) data represents the unknown to find.

- Find the starting value (SV) of an asset, such as the value paid for a stock or the current income of a company.

- Determine the time period (T) you want to analyze, such as the number of years, months, quarters, and so on.

- Enter the CAGR value as a decimal number; for example, a growth rate of 24.9% that you calculated in the first method can be rewritten as 0, 249.

Step 2. Calculate the future growth figure using the CAGR

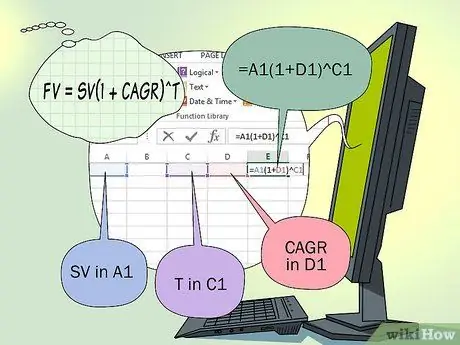

The formula in this case is: FV = SV (1 + CAGR) ^ T. Simply replace the variables with solid data, just like you did previously for the growth rate; you can proceed to carry out the operations using a computer or a calculator.

To use a computer, open a spreadsheet and type the equation in an empty cell. For example, a possible procedure with Excel involves transcribing the SV data in cell A1, the CAGR in D1 and T in cell C1. To find FV, the future value, type this function in a blank cell and press "Enter": = A1 (1 + D1) ^ C1

Step 3. Analyze the result

When you use the cumulative growth rate to predict future values, remember that no historical data can provide a certain result; however, this method can be useful for obtaining a fairly realistic estimate. Consider that the CAGR represents an average of the data considered and that, for each year or period of time you are studying, it could be higher or lower.

Advice

- Although the CAGR, being a financial parameter, is the primary method for calculating the compound growth rate described in this article, the calculation process is also valid for other scientific applications. The same equation is used to find the compound growth rate between any two values that belong to two distinct time references.

- Remember that the CAGR formula provides "rounded" or "estimated" data, this means that it is reliable only if you assume that there has been a more or less constant economic history.