You can use a spreadsheet to compile your budget and better control your expenses. You will be surprised how easy it is to manage your finances with this tool. You can use it as a guide to paying bills, saving money for retirement or major purchases, or simply getting to your next paycheck without incurring debt. In all cases, you will get closer than ever to financial freedom.

Steps

Part 1 of 3: Creating the Spreadsheet

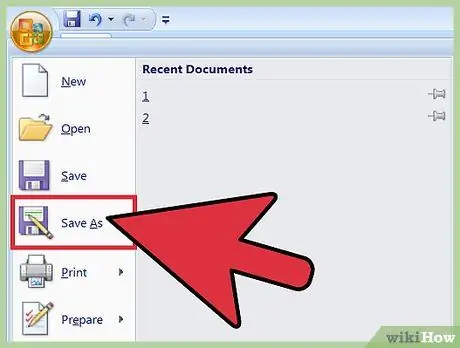

Step 1. Open the spreadsheet program of your choice

To create the budget, you need a specific program. On the internet you can find many for free if you don't already have an application like Microsoft Excel or Numbers installed. For example Google Drive, Apache OpenOffice, Zoho Sheet and Excel Online are just some of the free options available. Once you've chosen the software, install it and open a new workbook (a set of sheets).

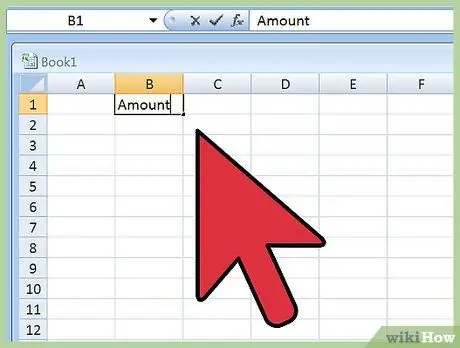

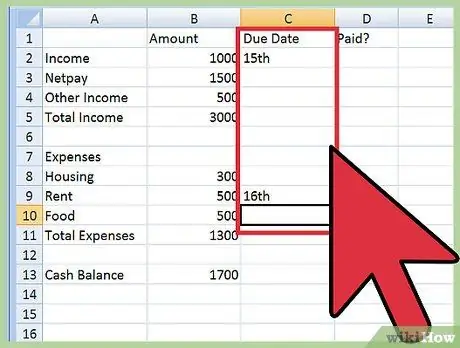

Step 2. Enter the column headings

Skip the first cell and write "Quantity" in cell B1. In this column you will indicate the value of all the elements of the sheet. Move to the adjacent cell on the right, C1 and write "Expiry". In this column you will write the due dates for payments and bills, if necessary. Move right again into cell D1 and write "Paid?" or something similar. This is an optional column that allows you to note whether expenses due by the dates indicated in column C have been paid.

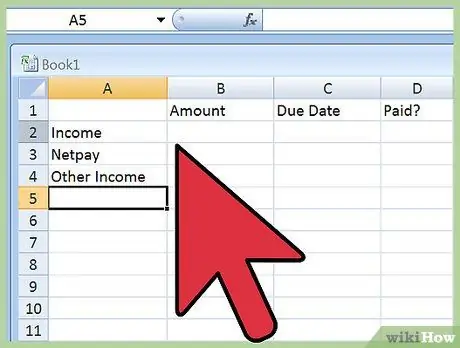

Step 3. Create cells to record monthly income

Start from cell A2, writing "Revenue". This title serves only as a header for the rest of the incoming elements. At that point, write "Net Salary" in the cell below, A3. Then, write "Other Income" in the lower cell, A4. In most cases, no other items will be needed for revenue. However, if you receive significant sums from other sources (investments, royalties, etc.), you can include additional lines for each specific type of income.

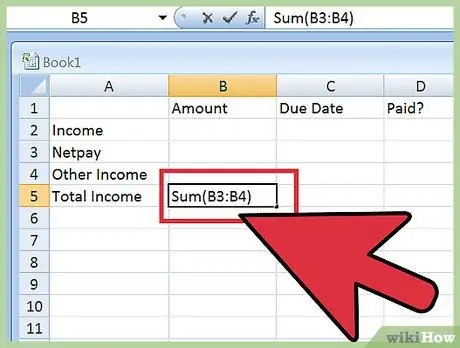

Step 4. Create a cell that calculates the total monthly income

Once you've created the cells for all types of income, you need one that makes up the monthly sum. Create it in the first available cell under the income entries (if you followed the guide and entered only "Net Salary" and "Other Income", this is cell A5). Write "Total Revenue" in it. In the cell immediately to the right (B5 in our example), you need to create a formula that calculates the total income, thanks to the SUM command.

- Start by typing "= SUM (" in that cell. At that point, click the cell to the right of "Net Salary" and drag the pointer down to the cell to the right of the last income entry. In this example, it is of cells B3 and B4. Alternatively, you can write the range of cells by entering the first and last, separated by colons, into the SUM function. The entire formula will look like this: = SUM (B3: B4).

- The Excel SUM function sums the values contained in the indicated cells, which can be entered individually (B2, B3, B4) or as a range (B2: B4). Excel offers many other functions that can be used to simplify calculations.

- If you get an error message when entering the formula, it means you made a mistake in writing. Double-check and make sure the format is the same as the example given in the previous step.

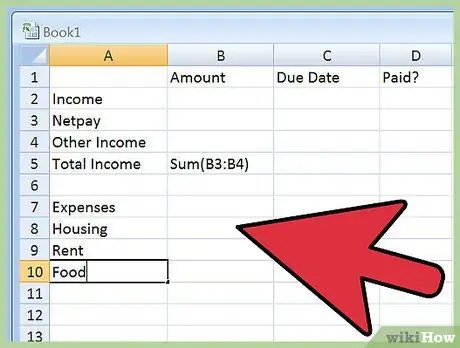

Step 5. Enter expense headers

As a next step, you need to write down your expenses just as you did for your income. There will likely be a lot more entries on this list. For this, it is easier to divide expenses into general categories. Start by skipping a line after the "Total Revenue" cell in column A and write "Expenses". In the lower cell, write "Home". This is the biggest expense for most people, so put it first. In the next cells, write down the various household expenses you incur each month, such as mortgage or rent payments, utility bills, and insurance, dedicating a cell to each item. Skip a line after this category and go to Food, following the same pattern. Here are some ideas for items and expense categories, in case you don't think of them:

- House: rent or mortgage; bills (electricity, gas, water); internet, satellite television, telephone; insurance; others (taxes, renovations, etc.)

- Food: shopping; dinners at the restaurant; other expenses for food

- Transportation: payments for car financing; RCA insurance; cost of public transport; fuel; parking / tolls; other transport costs

- Health: medical expenses; medications; other health expenses

- Personal / family expenses: money sent to relatives; alimony allowance; nursery; clothes / footwear; laundry; charity; fun; other personal expenses

- Financial expenses: credit card expenses; expenses for checks; Bank charges; other expenses

- Other: school debts; school expenses; credit card payments; money set aside as savings; various

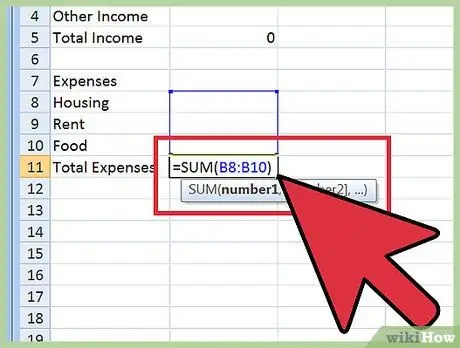

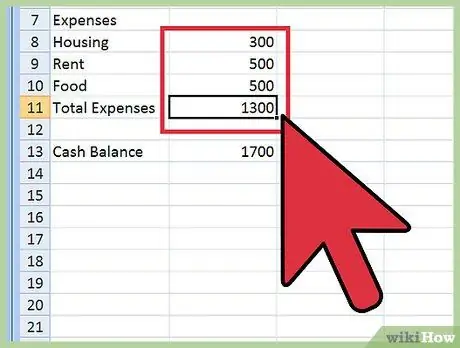

Step 6. Add up the expenses

Once you have written all the expense categories, you need to create a cell that automatically adds them. As you did for revenue, create a new cell under the last expense item and write in "Total expenses". In the cell directly to the right of that, enter the sum formula. Again, just type "= SUM (", then drag the pointer from the cell to the right of the first expense item to the one to the right of the last expense item. program will ignore them.

- For example, in this case the sum equation can have the following format: = SUM (B9: B30).

- Make sure you always close the parentheses of the equations.

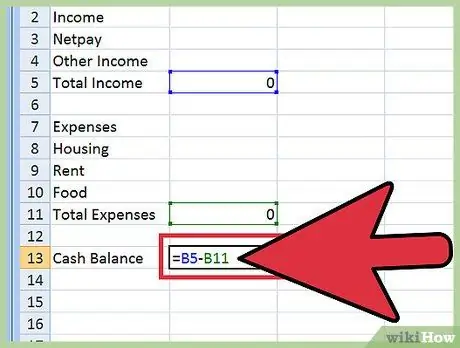

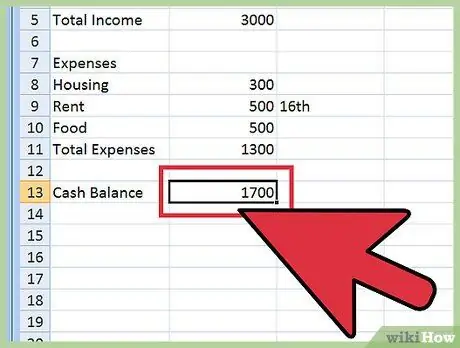

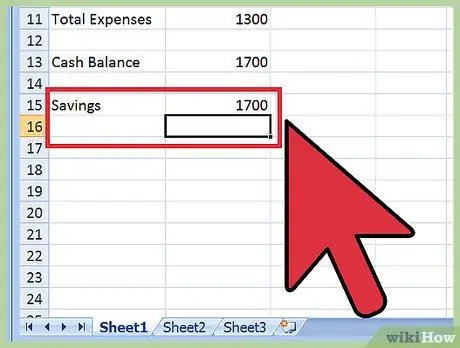

Step 7. Write an equation to find monthly cash flow

Skip another line below the cell in column A where you wrote "Total Expenses" and write "Monthly Budget". You will use this cell to calculate the difference between income and expenses. In the cell on the right, enter the required formula. Start by typing "=", then click on the cell in column B which contains the formula for total income. At that point, write "-" and click on the cell of column B which contains the formula of the total expenses. Thanks to the formula you wrote, the difference between the two values will appear in the cell.

For example, the equation might be "= B5-B31". Note that no parentheses are required in this case

Part 2 of 3: Enter Information

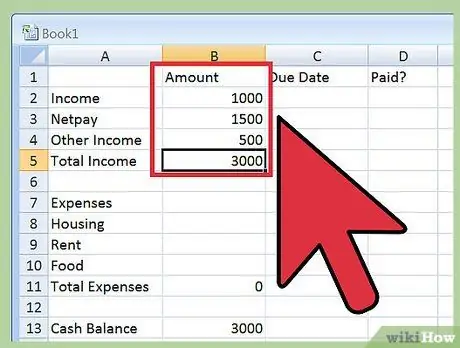

Step 1. Enter your sources of income

Write down your monthly salary after taxes, benefits and other changes to your salary in the cell to the right of the "Net Salary" heading. Next, enter your other income (such as alimony checks or other payments) in the cell next to the one with the appropriate heading. Repeat for all income items.

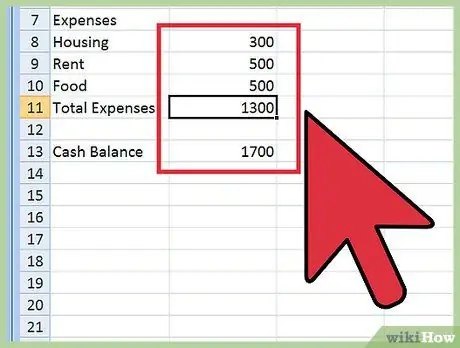

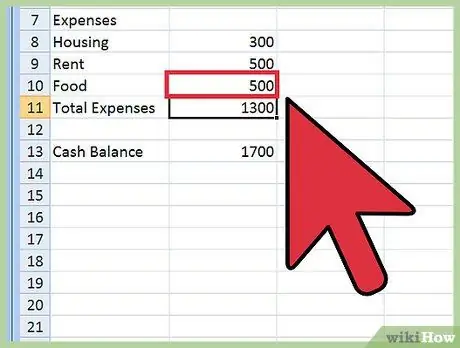

Step 2. Include all expenses

Enter the various expenses in the cells of column B next to those with the appropriate heading. Make sure you include the total expenses in the month you are analyzing, not just the amount up to the current day.

Step 3. If applicable, enter deadlines

Next to expenses related to bills or payments (such as bills for home, satellite television, mortgages or loans), write the date by which they must be paid in column C. It doesn't matter which format you choose for the date, but make sure that it is easy to consult. If you have already paid an expense this month, be sure to indicate this in the appropriate cell of column D by entering Yes or an X, depending on your system.

Step 4. Check that the formulas work

Look at the total income, total expenses, and cash flow after entering the individual values, so that you can verify the validity of the formula. If there is an error, the program should point it out to you with a warning in the equation cell. To be even more secure, you can use a calculator to check the accounts.

A common error message is a circular reference. This means that the range used for an equation includes the cell in which the formula is contained. In this case, the message "Excel cannot calculate the formula" appears. Check the cell range of the equation and make sure you entered it correctly (it should only include the value cells and not the formula itself)

Part 3 of 3: Plan Your Savings

Step 1. Analyze your monthly cash flow

This value measures how much money you have left at the end of the month after considering your expenses. If the number is positive, you may want to consider setting aside some savings. If it is negative, you should look at your expenses and understand where you can reduce them.

Step 2. Look for areas where you spend too much

Seeing the sum of your expenses in this way can help you notice that you are spending more than you thought on some items. For example, you may not realize that spending € 10 on lunch every day means € 300 a month for just that meal. If this is the case, you might want to consider making a sandwich at home or looking for cheaper alternatives. If necessary, look for similar cases in which to contain expenses.

Step 3. Analyze the spending trend

Once you've completed various monthly budgets, you can use them to consider how your outgoings vary over time. For example, you may have spent more and more money on entertainment or your satellite TV bill has gone up without you noticing. Compare expenses from month to month to see if they remain more or less constant. If not, study the problem better.

Step 4. Find ways to save more

Once you have cut some expenses you can save more money each month; increase the "savings" expense item or the one you have chosen to indicate savings. You can do this by taking advantage of the most favorable cash flow, then start the process again. This will help you spend less and less over time and save more.