Owning a small business brings with it unique challenges, which affect in particular the size and functions of the company. The owner must navigate between sales, distribution, financing, management and business growth with little or no staff, all while trying to stay afloat. To gain momentum in a short space of time, it is essential to keep the interest of everyone involved, such as customers, salespeople and staff, high. In any case, managing a small company can be quite rewarding, from a personal and economic point of view.

Steps

Method 1 of 4: Writing the Business Plan Effectively

Step 1. Write down your idea

It is important to write down everything that comes to mind. Successful companies offer innovative products or services, or enter an existing market niche. Whatever your reason for undertaking a business venture, be sure to write it in a clear and concise manner.

- It may be useful to make more than one draft of the business plan.

- Include as many details as possible. Thinking (even too much) on details is always preferable to ignoring them.

- It may be helpful to include questions in early business plan drafts. Giving voice to your doubts is just as effective as listing things you are sure of. It is not the case for potential investors to read a final business plan with many questions and few answers. Writing relevant questions in all of the initial drafts will help you identify the questions you will need to answer in the final copy.

Step 2. Look for small business support associations that can help you develop an effective and compelling business plan for free

They will also be able to help you in the later stages.

Step 3. Identify your customer base

In the business plan, you need to identify who you think can buy your product or service. Why would he need it or would he want it? The answer to these questions should help you determine all other aspects of your business operations.

In this case, it is useful to ask yourself questions about your service or product. For example, you might ask yourself, "Would my product or service be of interest to a young or adult market?", "Can low-income consumers afford my product or service, or would it be a luxury purchase?", "The my product or service might be of interest to people who live in certain environments? ". If you sell thermal tires, you will never be able to have large volumes of sales in Hawaii. If you sell beach towels, you will not be successful in Greenland. In short, be realistic in evaluating the interest of a product

Step 4. Define the financial aspect

In the business plan, you have to deal with fundamental questions regarding your financial situation.

How will your product or service generate money? How much will it make you cash? How much does it cost to create your product or service? How do you intend to pay for operational costs and employees? These, and others, are critical questions you need to answer in order to plan your company's financial future

Step 5. Plan your growth

To be successful, small businesses need to nurture their customer base and manufacturing capabilities in the first few years of business. Make sure you understand how your business can and will respond to growth potential.

Be realistic with your growth potential. Keep in mind that developing a business also requires a growth in investment capital. Estimating excessive growth in a very short period of time can immediately dissuade potential investors

Method 2 of 4: Implement Good Financial Habits

Step 1. Let your bank do the work for you

Learn how to run your business efficiently from a financial point of view by exploring all the solutions that banks offer to small business owners and choosing the one that suits your business plan. Many financial institutions have low-cost accounts, low-interest loans, or free direct deposit programs for small business owners. Choosing a bank that offers benefits helps you make the most of every single euro.

Use offers from competing banks to make counter-proposals, so you can secure higher prepaid capital and lower interest rates. For example, if a bank offers you a $ 10,000 loan at an interest rate of 4%, you could take this offer to a competing bank to see if they are willing to offer you a higher starting capital or a lower interest rate

Step 2. Secure a loan or other type of investment

Successful businesses need capital to keep going. You need to be sure that you are financially organized and have enough support to cover all the costs of operating, manufacturing and marketing your business, to the point of putting it in a position to generate and manage the profits on its own.

Be sure to inquire about the various interest rates applied to small business loans

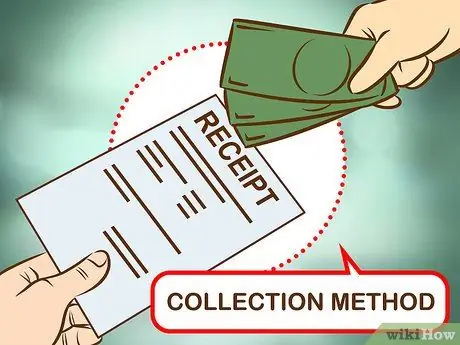

Step 3. Make sure you have effective ways to raise the money

You need to develop a system for your company to collect the money it owes on time and recover the money from debtors. To be successful, a business needs constant cash flow. If you are unable to accept customer payments or wait for debtors to make themselves heard, this will hinder your business.

- You must decide whether to accept cash, credit cards, checks, or a combination of these three methods from customers.

- Cash transactions are the easiest to manage on a daily basis, but are often difficult to track in the long run. In addition, it is more difficult to control incoming cash flow in this mode, as it is easier for employees to steal.

- Accepting checks helps prevent theft from within, but these bonds can rebound, resulting in problems with the bank.

- Credit and debit cards are usually the safest forms of payment, but accepting them means you have additional fees to pay to the various institutions that issue them. Consider all of this in light of the size and complexity of your business - it may not be worth it.

Step 4. You could use an app to check credits

There are several that help small businesses optimize cash flow. In fact, it is possible to manage more effectively the daily receipt of cash and the control of customer loans. This would allow you to welcome new customers or monitor existing ones, taking care of paying invoices or managing the cash received in a more secure way. There are various software vendors that are useful in this regard, such as iKMC, which allows you to take a free trial.

Step 5. Manage your warehouse efficiently

This factor can impact the success of a small retail store, so coordinate it carefully to make sure you are maximizing every dollar you spend. Invest in small amounts first, then keep checking the numbers to find out what sells and what doesn't. Rotate your inventory frequently to eliminate what sells the least and replace it with new items.

Inventory management is often dictated by the useful life of the product you sell. For example, when dealing with perishable items, it is essential to first remove the older ones from the warehouse to maximize the company's profits

Step 6. Consider hiring a finance expert

It may be useful to assign control of the financial part of the business to a specialist. An accountant can help you identify aspects of the business that are not functioning efficiently from a tax point of view, allowing you to maximize profits.

You don't necessarily need a full-time employee to handle the financial side. For example, if you have a solid understanding of inventory and cash flow management, you may only need an accountant when it comes time to pay taxes

Method 3 of 4: Running a Small Business

Step 1. Get all the permissions you need

Remember to register your company and acquire a specific license for its category. This is an important step to make sure you are managing it according to industry laws and regulations. Be sure to apply for permits related to the particular services you offer, such as home repairs or tax assistance, for which registration and certification may be required. If your company does not operate under the required licenses and permits, you will not be able to hire employees.

Not all businesses need permits. Make sure you contact the competent authorities of the area where you live to find out more about your specific case

Step 2. Look for qualified employees

Employ people who have expertise in the field of your business, such as accountants or experienced electrical repair technicians. If all employees are qualified, you will be confident in their abilities and this will boost customer confidence in your business.

Step 3. Be organized

Organizing time, employees, finances, and inventory is one of the secrets to successfully running a small business. Develop a spreadsheet that helps you keep track of the most important details so you don't have to remember them by heart, and set aside time - at least once a week - to review everything.

Organizing weekly, fortnightly or monthly staff meetings can ensure that everyone is on the same page and will help you avoid wasting time or overlapping employee responsibilities. The meetings can also help to understand who is adequately taking care of their assigned work and who is not

Step 4. Delegate responsibilities

You can't do it all by yourself, so delegate tasks and duties to qualified employees. Small businesses often need people who are willing to accept a lot of commitments and responsibilities that don't quite fit into their job description.

- It is often helpful to divide general business operations into specific assignments and delegate them to various employees or staff members.

- Also, when delegating responsibilities, be sure to assign supervision of a specific function to a qualified person. For example, an accountant shouldn't legally represent you, just as a lawyer shouldn't deal with the books. Thinking about operations in these terms should also help you identify your needs during the employee hiring process.

Step 5. Get involved

Once the responsibilities of the various tasks are assigned, you need to get involved to make sure that all employees are taking care of the tasks that are due to them. Also, respond to customer needs in a diligent manner. Make sure you are aware of customer requests and opinions. Don't shy away from being given the opportunity to have direct customer contact, even if this task was assigned to an employee.

- Every now and then it will be necessary to hire or fire someone. You must be aware of all laws regarding work equality and discrimination in areas such as hiring, firing, rules and treatment of employees.

- Leaving customer opinions in the hands of employees alone is a dangerous management tactic. Employees can gain personal gain by giving you biased information about customer satisfaction or product usefulness, which, in turn, will lead you to make bad decisions for the company in general. As a result, don't just accept what your employees say without first confirming its truthfulness - the business is yours and you have put yourself on the line by taking a lot of risks, so supervise the results proactively.

Method 4 of 4: Cultivate a Customer Base

Step 1. Make use of targeted promotional and marketing campaigns

It is important to advertise your business. Make sure your marketing money is well spent by conducting demographic research. This will help you tailor your marketing plan to be as effective as possible.

- It is good to think about promotions and marketing tactics that are suitable for your business. Investing in a commercial on a national network won't do much if your company was designed to operate only locally.

- Think about who would be most likely to buy your product and why. For example, if you sell dentures, it is useless to consider the market share of young people.

Step 2. Network as much as possible

Be supported by other small businesses in the area by networking with owners. Join the associations present in your area and participate in events to make your company known. Try not to miss the initiatives promoted by the community, so that potential customers are aware of the services you offer.

Step 3. Know the industry

You must always be aware of the news and trends in the field, so that your small business can be competitive in the sector. Subscribe to magazines or subscribe to newsletters to keep up to date on events. Always being informed will help you steal customers from the competition.

Step 4. Offer references

Write a list of satisfied customers and willing to put in a good word to help you attract potential customers. Future customers will thus have the opportunity to verify your work and customer service.

Step 5. Be accessible

Make sure potential customers can get in touch with you and the company whenever they need it. The best way to cultivate a good reputation and arouse respect is to be attentive to customer needs.

Large companies can afford to be careless and lose customers from time to time; small businesses do not. As a small business owner, it's up to you and your business to make yourself accessible to potential customers and those you already have. As you try to make your way, it may be necessary to provide your mobile number or personal email address

Step 6. Keep your promises

Your company will have to offer a product or service that has certain requirements for it to become popular. However, if you want to grow your clientele (and therefore your business), you must not only give people what they want, but also what you promised. If the product or service does not live up to your advertising, you will have a lot of difficulty in cultivating a solid customer base.