The Internal Revenue Service ("IRS") "Form 1040" - the United States Revenue Agency Form 1040 - is used to calculate and file your tax return with the IRS each year. Most people, including spouses, who earned more than $ 3,700 in the fiscal year, should use this template or one of its variations (for example, Form 1040-A or 1040-EZ) for tax returns. income tax. If you live and work in the United States, please read the instructions below to complete Form 1040 and submit it to the Internal Revenue Service.

Steps

Method 1 of 1: Fill out the IRS Form 1040

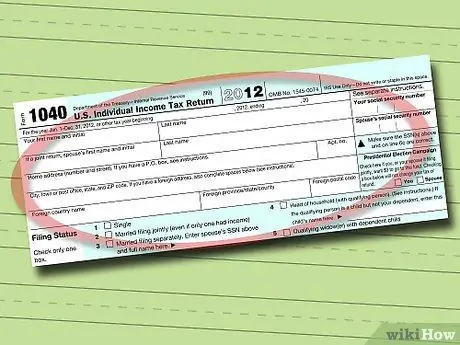

Step 1. Enter your personal information

You must provide the IRS with your full name, correct social security number, and current mailing address. As you complete this section of Form 1040, keep these things in mind:

- If you have recently changed your name as a result of a marriage, divorce or any other reason, be sure to report the change to the "Social Security Administration" ("SSA") before submitting the tax return. This way you will avoid delays in processing your return and can also ensure that future social security contributions are protected.

- A missing, incomplete or incorrect tax number on your tax return can delay processing, reduce any refunds and / or increase taxes. Check two or even three times that you have entered the correct tax code.

- If you have an address outside of the United States ("US"), enter the city name in the correct space, leave the rest of the line blank, and then complete the one below. Follow the foreign country practice for entering the name of the country, state or province and postcode.

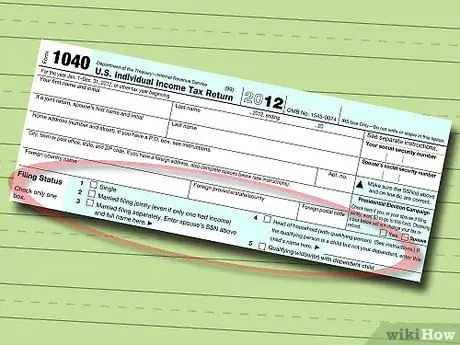

Step 2. Determine the status of the tax return and check the appropriate box on lines 1-5

You can only check one box. Available statuses include:

- Single (celibate or single). Check the single box if you were legally divorced or unmarried on December 31 of the fiscal year, or if you became a widower before the start of the fiscal year (January 1) and not remarried at the end of the fiscal year. If you are a widower and have dependent children, however, you can reduce the amount of tax payable or increase the amount of the refund by choosing a widower (or widow) with dependent children.

- Married filing jointly. For federal income tax purposes, married means you are in a legal partnership with a person of the opposite sex. You can choose married filing jointly if you were married at the end of the fiscal year, if your spouse died during the fiscal year and did not remarry by the end of the fiscal year, or if you got married at the end of the fiscal year and spouse died the following year before filing the income tax return.

- Married filing separately. You can select this item if you do not wish to file a joint declaration with your spouse, even if you are qualified to choose married filing jointly status. Generally married couples make the joint declaration, however, in certain situations, for example when one of the spouses owes back taxes or child support which can be taken directly from the income tax refund, it may make more sense for the spouses declare income separately. You may want to consult with a certified public accountant (CPA), tax consultant, or IRS registered agent to determine if it is best to produce a separate tax return.

- Head of household. The head of household is a special status in the tax return intended for unmarried, married and individuals who provide a home to other individuals who may be dependent parents, dependent unmarried children or children not dependent or dependent due to divorce, but of which you are the custodial parent. See page 13 of Form 1040 for instructions for complete information on this status. Instructions can be found on the IRS website.

- Qualified widow (er) with dependant child. You can choose this status if all of the following conditions are met: the spouse has died in the last three calendar years; you did not get married before the end of the current fiscal year; the children lived at home for the entire fiscal year; you paid more than half of your home maintenance costs, and you could have filed a joint tax return with your spouse the year he died, even if you didn't.

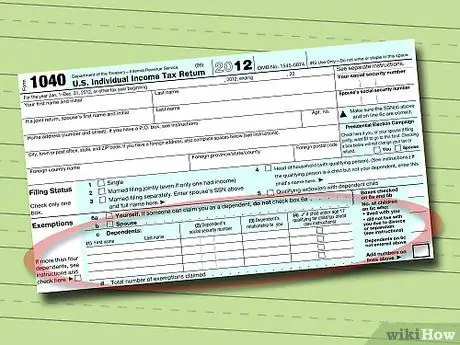

Step 3. Fill in the Exemptions section contained in line 6 a-d

To complete this section, please follow these steps:

- Check the 'yourself' box, unless someone else includes you in their taxes.

- Check the spouse box if you are married. Remember that for federal income tax purposes, the term "spouse" means a legal partnership with a person of the opposite sex.

- Enter the information of your dependents in the spaces provided on line 6c 1-3.

- Determine if each dependent listed is a child in order to obtain the child tax deduction using the flowchart on page 15 of Form 1040. Instructions are found at this link. Check the box on line 6c (4), if that's right for you.

- Fill in the boxes on the right, following the instructions, to determine the numbers to be entered in each box, then add all the numbers in the boxes and put the total of the last box on line 6d.

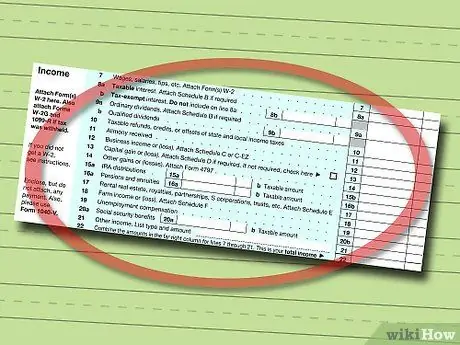

Step 4. Fill in the Income (income) section contained in lines 7-22

For more information on each type of income and the people who earned it, see the instructions on pages 19-27 of Form 1040. You can find them on the IRS website at this address.

- Most registrants will have to enter their W-2 information on line 7.

- If you have not received the 1099 form or other federal document showing what income you have earned, it is assumed that you have not achieved that type of income.

- All registrants should complete lines 7-21 and enter the total on line 22.

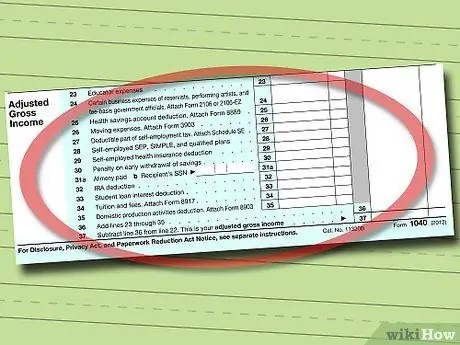

Step 5. Fill in the Adjusted Gross Income section contained in lines 23-37

For more information on each adjustment and who can make it, see the instructions on pages 28-33 of Form 1040. You will find the instructions on the IRS website at this address.

- If you do not request any corrections in this section, simply copy the number from lines 22 to 37.

- If you request any corrections, complete lines 23-35 and enter the total in line 36. Then, subtract the figure in line 36 from that of 22 and enter the total in line 37. For example, if in line 36 you write $ 3,600 dollars and on 22 you carry $ 35,400, you should subtract $ 3600 from $ 35,400 and insert $ 31,800 in line 37.

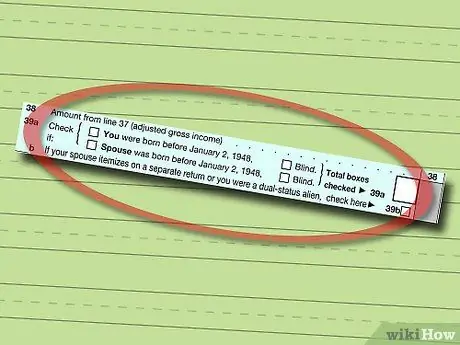

Step 6. Fill in lines 38 and 39

To do this, copy the amount from lines 37 to 38 and check the appropriate boxes in line 39, if you or your spouse were blind during the fiscal year and / or if your spouse produces a separate declaration or if you were a dual status immigrant.

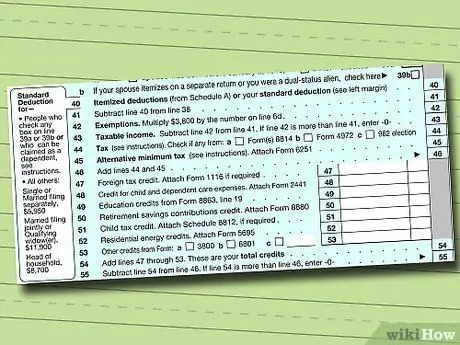

Step 7. Decide whether to detail your deductions or use the standard deduction for your status

To make this decision:

- Complete Schedule A of the IRS. Schedule A (Schedule A) can be found on the IRS website at this address.

- Find the standard deduction. Most of those who make use of the standard deduction can find it on Form 1040 in the box to the left of line 40. However, if someone else declares you to be dependent, if you were born before January 2, 1947 or were blind during the fiscal year, you must use the worksheets on page 34 of Form 1040. Instructions for determining the standard deduction can be found here.

- Compare the amount on line 29 of Schedule A with your standard deduction. While there are a limited number of cases where a person would like to detail their deductions, including if the standard deduction is greater, most registrants should take the larger deduction. Contact a CPA, tax attorney, or IRS registered agent for more information on how to detail deductions when the standard is higher.

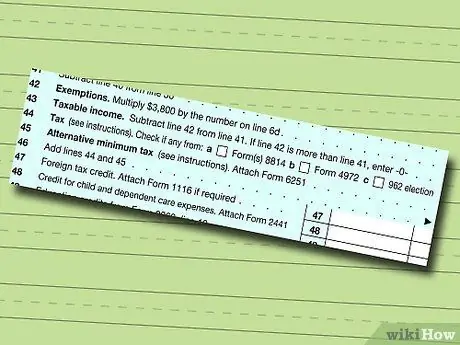

Step 8. Calculate your taxable income

Taxable income can be calculated using a simple mathematical equation, found in lines 41-43 of Form 1040.

Step 9. Determine the amount of your taxes

To determine the amount of tax, look for your taxable income in line 43 in the tax tables you can find on this page. Make sure you use the number in the column listing your status.

Step 10. Determine which deductions to calculate and fill in the relevant lines

For complete information on each deduction and who can take it, read pages 38-42 of Form 1040. Instructions are on this page.

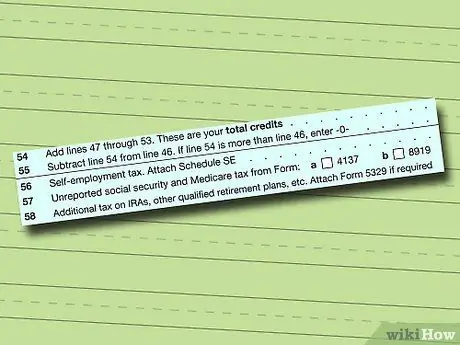

Step 11. Fill in lines 54 and 55

To do this, add your deductions present on lines 47-53 and insert the total on 54. Then subtract from the total taxes, shown in line 46, the amount of the deductions in line 54. For example, if line 54 is written $ 4500 and $ 2,600 on 46, you should subtract $ 2600 from $ 4500 and put $ 1900 on line 55.

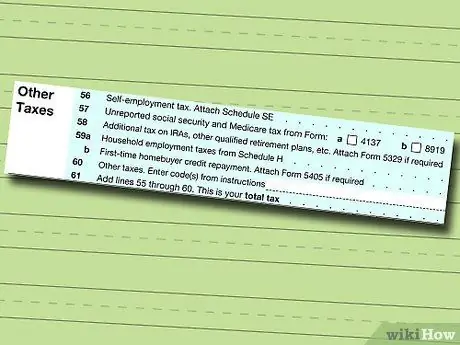

Step 12. Complete the section Other Taxes contained in lines 56-61

Most registrants will have no additional taxes to report in this section, so they can simply copy the figure from lines 55 to 61. For complete information on other taxes and who owes them, read pages 42-44 of Form 1040 Instructions can be found on this page.

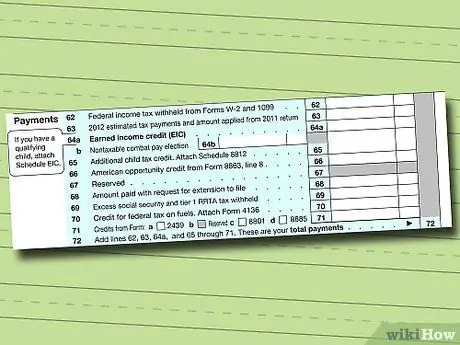

Step 13. Fill in the Payments section contained in lines 62-72

Most registrants will only need to fill in a line or two in this section. For complete information on each deduction and who can take it, read the instructions on pages 44-69 of Form 1040. They are listed on the IRS website at this address. All registrants should complete lines 62-71 and enter the total over 72.

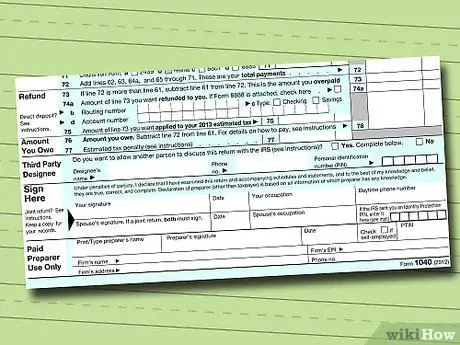

Step 14. Determine if you need to pay additional taxes or if you will receive a refund

Read lines 61 and 72. 61 corresponds to total taxes, while 72 corresponds to the amount you have already paid for these taxes.

- If the figure corresponding to line 72 is higher than that of 61, you will have to receive a refund. Subtract the amount on line 61 from the amount on line 72 and insert the difference on line 73.

- If the figure on line 61 is higher than that of 72, you will have to pay an additional tax. Subtract, then, the amount corresponding to line 72 from that present on 61 and insert the difference on 76.

Advice

- Fill out IRS Form 1040 in pencil. Once you have completed the form, fill in a second copy in pen. Keep the pencil copy in your documents and mail the ink copy to the IRS.

- If you are unsure about completing Form 1040 and any required forms or schedules, consult a good tax and tax professional for assistance.

- The IRS makes help centers available to taxpayers when they believe that a problem cannot be handled over the phone. To find out where they are, visit the IRS website at this address.

- If you need more information about a form, schedule, or statement made with Form 1040, you can visit the IRS website or call the IRS for telephone assistance at 1-800-829-1040. If you are hard of hearing, you can call 1-800-829-4059 (TDD).

Warnings

- Don't sign an unfinished tax return and don't leave it to an accountant. Once a good tax professional fills out Form 1040 and answers any questions you ask, then you can sign it.

- Be specific. Falsifying or providing inadequate information could trigger red flags on your tax return from the IRS and consequently trigger a tax assessment.