If you've just received your debit card or ATM in the mail, you can use it at any ATM in your country. You can also use it to withdraw cash. Here's how to do it!

Steps

Step 1. Walk or drive to the ATM

Step 2. Insert your debit or ATM card face up into the ATM

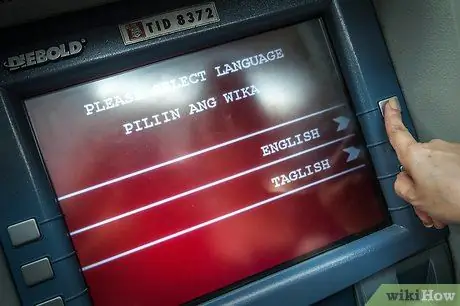

Step 3. Select your language

Step 4. Cover the numeric keypad or touch screen with your whole hand as you enter the PIN code

Tap or press Continue or Enter.

Step 5. From the main menu, tap or press Withdraw

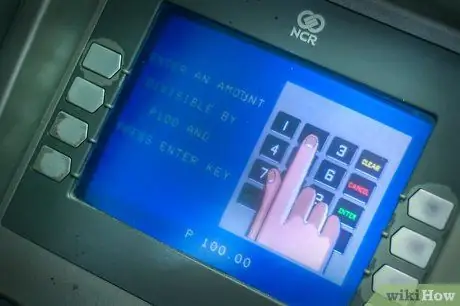

Step 6. Enter the amount of money you want to withdraw and press or tap Ok or Confirm

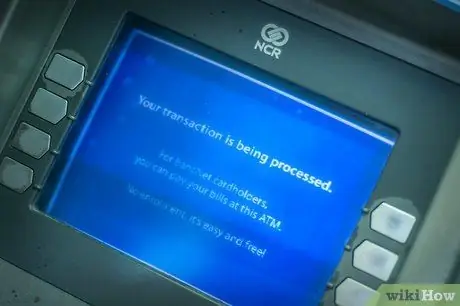

Step 7. Wait while the machine executes the transaction

Step 8. If it's not your bank, press or tap Yes or Accept Commission Fees

Step 9. Press Yes or No or tap Yes or No to get a receipt or not

Step 10. Take your money and, if applicable, the receipt