Sign here please! Before a check can be cashed or deposited, it must be properly stamped by the receiving party. Knowing how to endorse - endorse - a check correctly is an essential piece of banking knowledge that ensures your money goes where it needs to go.

Steps

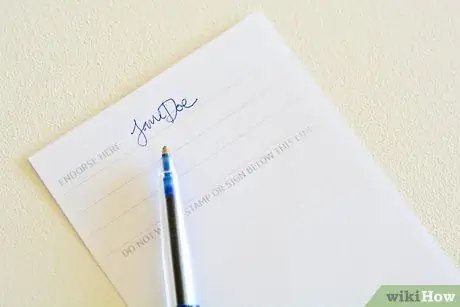

Method 1 of 5: Sign Only

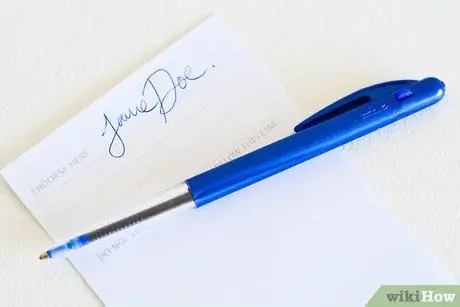

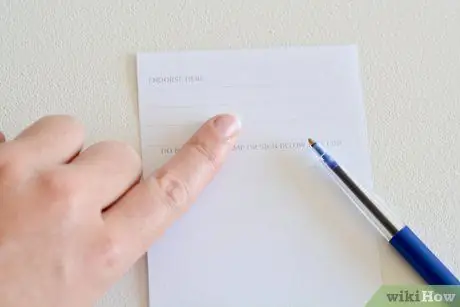

Step 1. Turn over the received check and find the set of gray equidistant lines

Whatever you do with this check, it will be writing on these lines - many checks will warn you to "do not write, stamp or sign below this line" to help you comply with this policy.

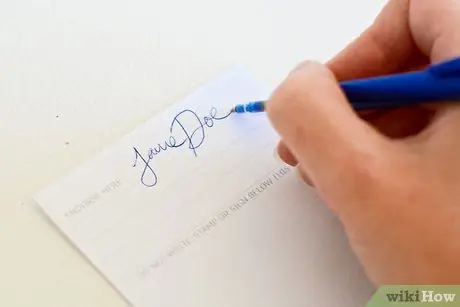

Step 2. Sign on one of the gray lines

Jot down your signature ostentatiously and in full. You can use this space in many ways, but to simply deposit or cash the check, the least you will need to do is sign your signature.

Make sure the name you sign with is the one on the check. If the front of the check specifies a credit for "James", do not sign "Mino". If the name on a check is incorrect (for example, Sara Bianchi, while your real name is Sarah Bianchi), sign the check as indicated on the front, then write the correct spelling below

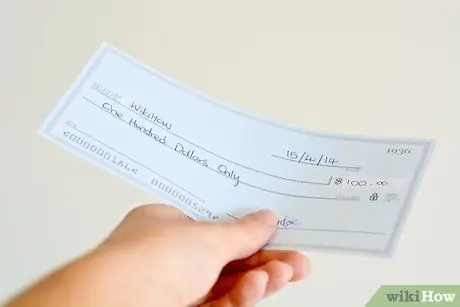

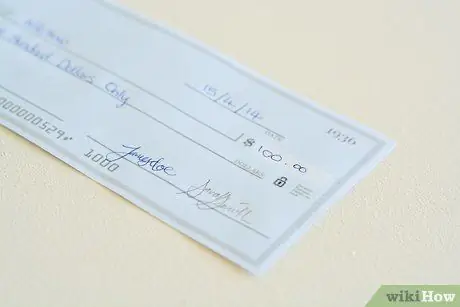

Step 3. Make sure all information on the front of the check is filled in correctly

The person who gave you the check must have written your name, signature, date and amount of the check (in words and also in numbers). Without all this information, the bank cannot pay the check.

Step 4. Take the check to your bank to cash or deposit it

Bring the check you received to one of the cashiers and ask them to deposit it in one of your accounts or simply exchange it for cash.

Many banks now have ATMs that allow checks to be deposited through an automated system

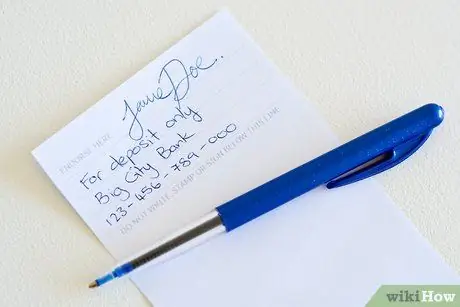

Method 2 of 5: Endorse a Deposit Only Check

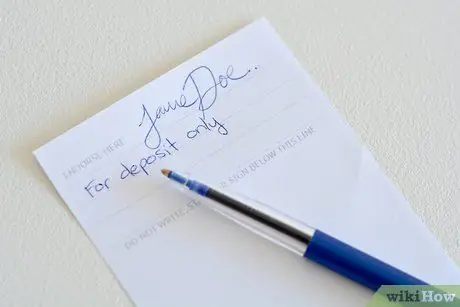

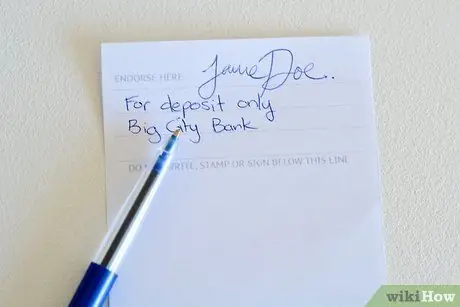

Step 1. Turn the check over and sign it on the top line of approval, as usual

You may need to sign more tightly to save space to write down the rest of the information.

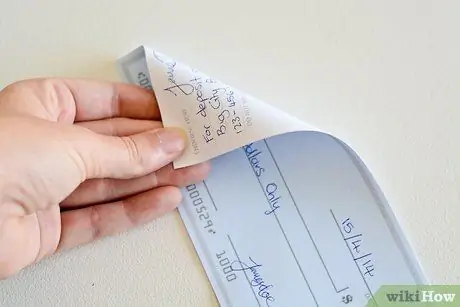

Step 2. Write "For deposit only" under your signature

This is useful when you want to make your check safer. That way, if you lose control or need someone else to deposit it on your behalf, no one but you will be able to use the funds.

Step 3. On the next line write the name of your bank

This will ensure that the check can only be used at that bank.

Step 4. On the third line write your account number

Make sure you write down the account number you want the check to be deposited into.

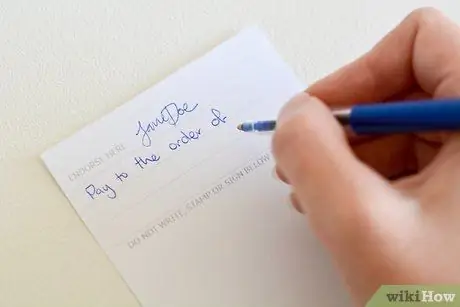

Method 3 of 5: Endorse a Check to Transfer It

Step 1. Sign on the top line

Once again, save some space, if possible, as you will write more.

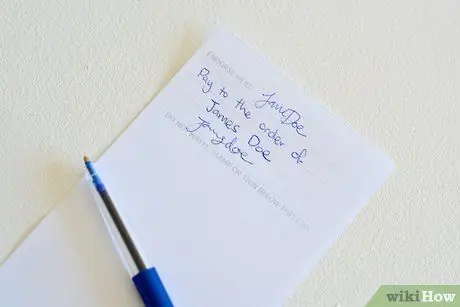

Step 2. Write "Pay by order of" in the second line

If you've received a check and want to give it to someone else, you can transfer it so that the person can deposit it into their account instead of yours.

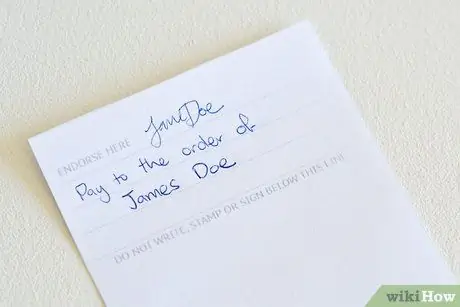

Step 3. Write the name of the person you transfer the check to in the third line

In this way, you turn the check to the beneficiary whose name you write.

Step 4. Have the person you are going to give the check to put their signature on the last line

Step 5. If necessary, go to the bank with the other person

Prudent banks may request your presence before depositing the check in favor of the person to whom you have endorsed it.

Method 4 of 5: Endorse Work Checks

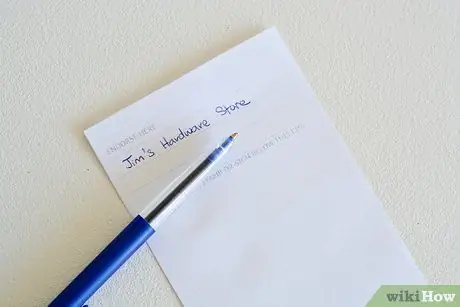

Step 1. Endorse the check with company information

Write on the gray lines on the back of the check.

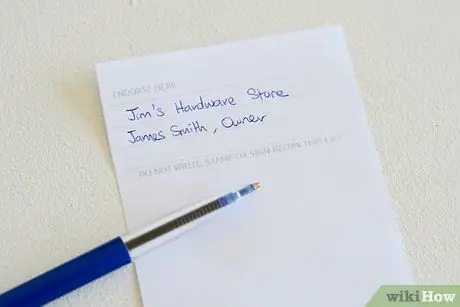

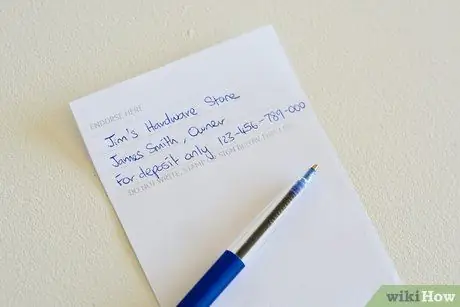

Step 2. On the first line, write your business name

For example, write “Giovanni's Hardware Store”. Use this method when a check is issued not to you personally, but to your business.

Step 3. On the next line, write your name and title

For example: “Giovanni Rossi, Owner”.

Step 4. If you want, type "Deposit only" with your bank and account number on the remaining lines

Business checks can be approved for deposit only as personal checks.

Method 5 of 5: Insurance Checks

Step 1. Have each side sign the check

This applies to checks made out to an individual, party or other financial institution. For example: "Pay to: Tizio, Caio & Banca XYZ".

Step 2. Request that a representative of the financial institution endorse the check

Most likely he will write additional information or stamp the check under his own signature.

Advice

- For checks involving multiple parts, addressed to two or more people with the word "and", all parties must sign the check.

- For checks involving multiple parts, addressed to two or more people with the word "or", either party can approve the check.

- Some financial institutions do not require the approval of the check before cashing or depositing it. Check with your bank to see if they are required to do this.

- To save a lot of time and effort, you can take a stamp that says "For Deposit Only" and your account number on it.

- Checks made out to a minor cannot be endorsed by him. A parent or guardian will have to endorse the check. Under the heading, write: "parent / guardian of [child name], minor".

Warnings

- Insurance checks are frequently returned for improper endorsement. Turn it exactly in the way the names are written on the front of the check.

- Note that it is not always necessary to write your account number when endorsing a deposit check. Simply write "For Deposit Only" with your signature below. Some security experts warn that writing your bank account number on the back of a check is a security risk, as it exposes the account number to third parties who could manipulate the check. This is probably not a big deal, considering that each checking account number is written at the bottom of each check, usually with name and address, and is exposed for scrutiny by clerks.

- To stay on the safe side, never put your signature without the words "Deposit Only" on the back of a check unless you are physically present at the bank. These words prevent others from endorsing the check with their name under yours for unfairly having control of your check and the money it represents.