If you've just gotten a new credit card, you'll need to sign it on the back before you start using it. Sign the card after activating it online or over the phone. Use a felt-tipped pen and sign as you would any other document. Do not leave the signature space blank on the back of the card and avoid writing "see document" instead of signing.

Steps

Part 1 of 2: Sign the Charter Clearly

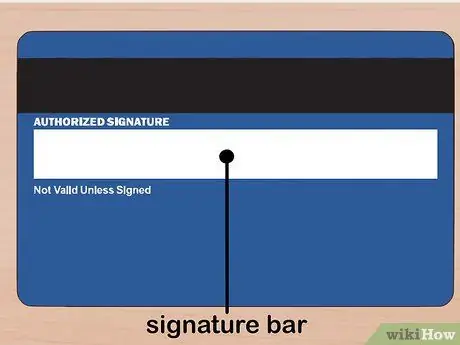

Step 1. Find the signature space

It is located on the back of the card. Turn the paper over to face the back side and look for the white or light gray color space.

Some cards have an adhesive film on the signature field. If it's also on yours, remove it before signing

Step 2. Sign using a felt-tipped pen

Since the back of the credit card is made of plastic, it does not absorb ink like a piece of paper would. A felt-tipped pen or an indelible pen will leave a signature that won't fade over time and you won't risk getting ink on your paper.

- Some prefer to sign their credit card with a fine-tipped marker. An advantage is that these markers hardly stain.

- Don't use unusual colors, such as red or green.

- Also, don't use a ballpoint pen. Ballpoint pens may scratch paper, or leave a faint, inconspicuous signature on the plastic.

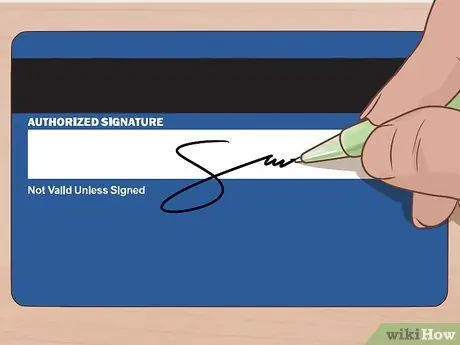

Step 3. Sign as you always do

Consistency and clarity are key when signing the back of a credit card. The signature on your credit card must be like the one you put on any other document.

- It's not a problem if your signature is confusing or hard to read, as long as it's the same one you always use.

- If a store employee suspects credit card fraud, the first thing they do is to compare the signature on the back of your card with the one on the receipt.

Step 4. Let the ink dry

Do not put away your credit card immediately after signing it. If you put the paper away too soon, you may cause ink smears and your signature will become unreadable.

Depending on the ink used, the signature can take up to 30 minutes to dry

Part 2 of 2: Common Mistakes to Avoid

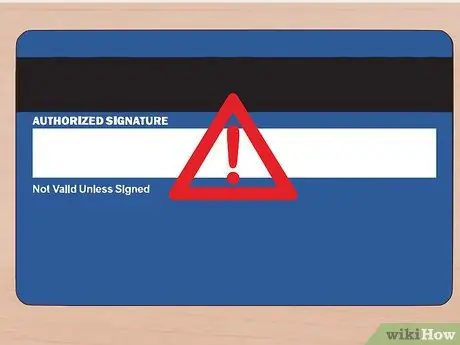

Step 1. Don't write "see document"

It is possible that someone has told you that you can protect yourself from the risk of fraud by writing "see document" or "see document" instead of putting your signature. The idea behind this is that if someone steals your credit card, they won't be able to use it unless they also have your ID. However, most merchants, by law, cannot accept credit cards that are not signed by the cardholder.

- Read the small note on the back of the card. It probably contains a declaration like "Invalid without an authorized signature".

- Plus, most clerks will swipe the card without even looking at the back to verify the signature.

Step 2. Do not leave the signature space blank

Technically, you are legally required to sign your credit card to validate it before use. Some salespeople may refuse to swipe your card if they see you haven't signed it.

- With the increasing prevalence of chip readers and self-service card readers (for example at gas stations), many salespeople do not have the opportunity to ask you to see your card.

- Leaving the back of your credit card blank does not increase its security in any way. Potentially, a thief could use the card with or without your signature.

Step 3. Make sure your card is fraud protected

If you are concerned about the possibility of a thief using your credit card to make purchases, the best way to protect yourself is to make sure the card is protected from fraud. Contact the Customer Service of the company that issued the credit card and ask if your account has fraud coverage.