Usually to deposit a check you had to go to the bank specifically, wait in line and wait even longer for it to be checked. Many other new and creative methods are now available to deposit any check into your account quickly and securely. In some banking networks, it is even possible to deposit a check with a smartphone!

Steps

Method 1 of 5: Deposit in the Bank

Step 1. Visit the bank

To make the deposit you will need to bring a check, a valid identity document and your account number with you.

Step 2. Fill out a deposit slip, which should be available at your bank in a stack on a table with pens and other forms

It is also possible to request one from the cashier, but the process will be faster if you prepare it in advance.

You will have to enter your account number, how much you want in cash (if you want) and in credit, the signature and the total amount of the check

Step 3. Scroll through the elements written on the front and back of the check to ensure the validity of its formal requirements

Verify that the following fields are correct, truthful, written and filled in legibly: name and address of the drawer, i.e. of the person or company issuing the check, the date of issue, name or company ID of the beneficiary and the amount written in duplicate form, numerical and alphabetical.

Both signatures are required on the check for it to be considered valid

Step 4. Ask the cashier to deposit the check into your account

The cashier can deposit the check, report your current balance and deliver the amount you want. It will give you a receipt or proof of deposit with the current balance.

Method 2 of 5: Deposit At an ATM

Step 1. Visit one of your bank's ATMs

Make sure the check is completed clearly and legibly and that you have endorsed it. It is important that you select an ATM from your bank. While most cash machines and ATMs will dispense money to anyone who inserts a valid debit card, the other ATM deposit options only work for underwriters of that particular bank.

Credit unions members will need to use an ATM from their particular credit institution

Step 2. Take out your debit or credit card and log into the ATM with your personal identification number (PIN)

If you don't have this information, you will need to go to the bank and speak to a cashier.

Step 3. From the menu, select "Deposit"

You should see a list of your savings accounts. Select the account you would like to deposit the check into. After that, you can choose between cash and check. Select the latter.

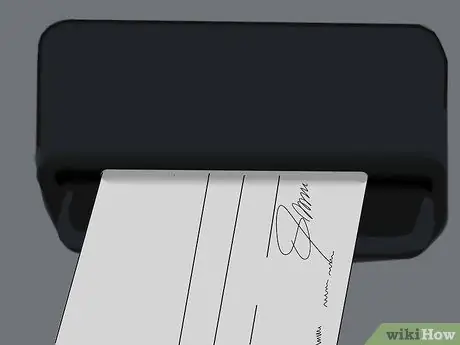

Step 4. Enter your checks

There should be an insert slot printed on the machine with directions on how to orient the check (up, down, etc.). Follow the directions and enter it. The ATM will then scan it and ask you to confirm the information it has read on the check. Examine them carefully to make sure that the ATM has correctly acquired the amount and account number.

Some ATMs allow you to insert up to ten checks at a time, but read the directions on the machine carefully before inserting more than one

Step 5. Carry out any other transactions you need

At this point, the ATM will give you the current balance and ask if you want to switch to another transaction. You will be able to withdraw cash, print a receipt or deposit money.

Method 3 of 5: Deposit with a Social Cooperative

Step 1. Visit any credit union

If you are a customer, you will be able to deposit checks at any branch of your cooperative or any other.

Step 2. Do not fill in a deposit slip

Queue up with your valid, endorsed check, and tell the bank cashier that you want to deposit the check but that you are a member of another credit union. You will need to provide the cashier with the check, a valid identity document, your account number, the name of your branch and possibly the address of the main office of your credit union.

There are hundreds of credit unions. The cashier will probably not know your specific cooperative, so you will need to make sure you give them the address when they look for it in the database

Step 3. Deposit the check into your account or savings account

This is also a good opportunity to withdraw cash without paying the usual fee for collecting cash at ATMs.

Method 4 of 5: Deposit with a Mobile App

Step 1. Download a mobile app, after checking if your bank has one

Some lenders have developed applications for mobile devices that, through photos, make it easy to pay a check. If available, download it to your cell phone or mobile device.

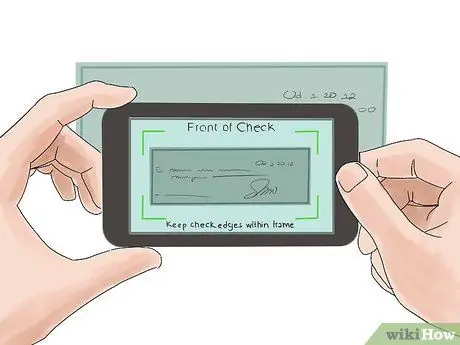

Step 2. Open the app and select Deposits

You should come to a screen with the options marked "Check Back" and "Check Front". Use them to photograph the front and back of your check with your endorsement signature.

Step 3. Select an account you would like to deposit the check into

Enter the amount of the check using the app and, on the confirmation screen, check that all the information is correct. If they are, click "Deposit this check".

You can choose to receive a confirmation email or text message when the check is deposited

Method 5 of 5: Send a Check by Mail

Step 1. Determine where to send the check

If it is too difficult to get to a branch of your bank or access online banking services from where you are, you can always send the check by post with a deposit slip. You will need to check with your bank to find out where to send the check. Call the toll-free number on the ATM and speak to a customer service representative to find out where to send the check.

In the US, for example, Bank of America lists a Phoenix, AZ address for all customers living in AZ, CA, ID, IL, IN, MI, NM, NV, OR, TX, and WA, and a Tampa address, FL for customers in all other states. If you ship overnight or via FedEx, however, the address will be different. You will need to check online or speak to an employee on the phone to get the correct address according to your bank and location

Step 2. Send your certified check with a deposit slip to the routing address in your area

You may need other information, such as a photocopy of your ID, so it's a good idea to speak to a representative of your bank before sending a check by post.

Step 3. Never send cash

You can't deposit money into your account this way, so make sure you only send checks. There is usually a cost associated with this type of transaction though, so try the other options before attempting to mail a check to deposit.