A balance sheet is an information document regarding the health of a company or organization and includes a balance sheet, an income statement and a cash flow statement. Financial statements are often audited and analyzed by business leaders, boards of directors, investors, financial analysts, and government agencies. These documents must be prepared and disseminated in a timely manner and must be clear and precise. While creating a balance sheet may seem daunting, the accounting experience required isn't particularly complex.

Steps

Part 1 of 4: Prepare to Write

Step 1. Establish the reference period

Before starting, you need to decide on the period to which the budget refers. Most of these documents are for a quarter or a year, although some companies also prepare them on a monthly basis.

- To establish the reporting period, check the company's governance documents, such as the bylaws or articles of incorporation. These types of documents often report how often a budget needs to be prepared.

- Ask an organization leader how often they should be prepared.

- If you are an executive in your organization, consider when the budget would be most useful for you and choose the reporting period consistently.

Step 2. Check the accounts

You must therefore be sure that what is reported in the accounts is updated and correctly recorded. The financial statements will be of no use if the accounting data are incorrect.

- For example, make sure that all data relating to the items to be settled and to be collected has been processed, verify that the reconciliation of bank accounts is in place, and make sure that all purchases and sales of goods and products have been recorded.

- You must also consider any items that may not be recorded on the balance sheet date. For example, has the company benefited from services that have not yet been billed? Are there wages and salaries that have not yet been paid? These items represent accruals and deferrals that must be recorded in the financial statements.

Step 3. Collect any missing information

If the review of the records reveals any gaps, find all the documents that are useful and necessary for the financial statements to be complete and correct.

Part 2 of 4: Prepare the Balance Sheet

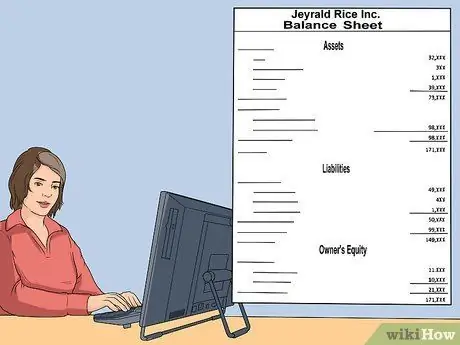

Step 1. Set up the balance sheet page

A balance sheet reports the company's assets (what it owns), its liabilities (what it owes) and equity accounts, such as the share capital and paid-up reserves. Head the first page of the financial statements with the title "Balance Sheet", then indicate the name of the organization and the effective reference date of this prospectus.

The balance sheet items are reported with reference to a specific day of the year. For example, December 31st

Step 2. Format the balance sheet properly

Typically, most report assets on the left and liabilities with equity on the right. Alternatively, you can report the assets at the top of the page and the liabilities with equity at the bottom.

Step 3. List the activities

Add the "Assets" stock to the first section of the balance sheet, then list the different assets held by the company.

- Start with current assets, such as cash and any items that can be converted into cash within one year of the balance sheet date. At the end of this section, enter a subtotal referring to current assets.

- Then list the non-circulating assets. They are those other than cash that cannot be monetized quickly. For example, real estate, equipment and receivables that are not immediately due are non-circulating assets. Enter a subtotal for this type of business.

- Finally, add up the subtotals for current and non-current assets and describe this row as "Total assets".

Step 4. List the passive

The next section of the balance sheet reports liabilities and equity. This section of the balance sheet should be titled "Liabilities and Equity".

- Start by listing your current liabilities. These are generally obligations to be settled within one year which include short-term payables, accruals and deferred income, mortgage installments referring to the current year and other payables to be paid. Enter a subtotal for current liabilities.

- Next, enter the long-term liabilities. These are liabilities that will not be settled within one year, such as long-term debts and other unpaid items in the short term. Enter a subtotal for long-term liabilities.

- Add up current and non-current liabilities and describe this row as "Total Liabilities".

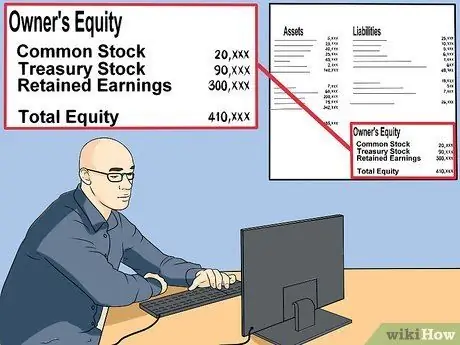

Step 5. List the lots that make up equity

The equity section of the balance sheet appears after the liabilities section and shows the amount of money the company could have if it realized all its assets and paid all the liabilities.

Lists all equity accounts, such as common stock, treasury stock, and profit / loss carried forward. Once all equity accounts are listed, add them together and add the caption "Total Equity"

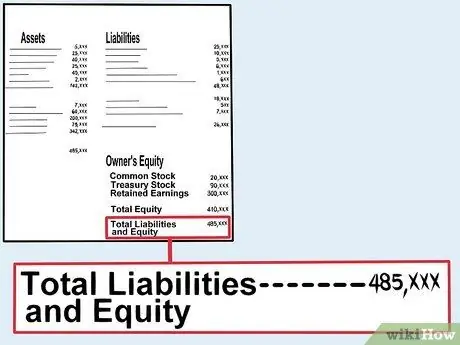

Step 6. Add the liability and equity

Add the totals of the "Total liabilities" and "Equity" sections. Headline the "Total Liabilities and Equity" row.

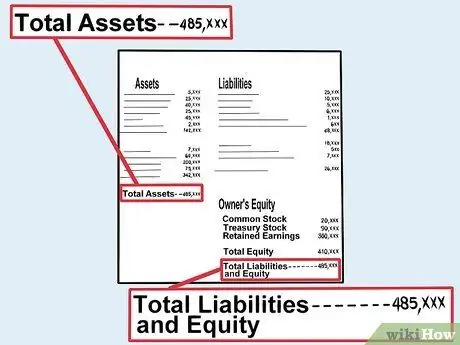

Step 7. Check your balance

The numbers you got for "Total Assets" and "Total Liabilities and Equity" should be the same. If this is the case, then the balance sheet is complete and you can start preparing the income statement.

- Equity must correspond to the assets of a company minus the liabilities. As mentioned above, it indicates the money that would remain available if all assets were realized and the bonds paid. Hence, the total liabilities together with the equity must equal the total assets.

- If the previous two totals don't match, double-check your job. You may have omitted or improperly classified one of your accounts. Double-check each column and make sure all the data you need is there. You may have omitted a material asset or liability.

Part 3 of 4: Prepare the Income Statement

Step 1. Set up the page for the income statement

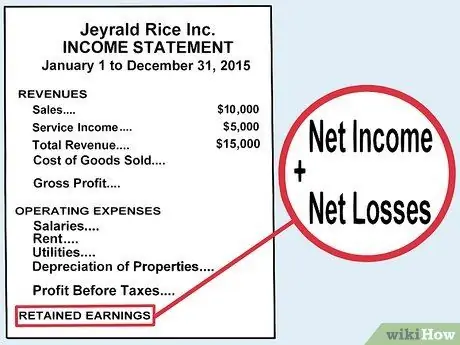

This report shows how much money a company has made and spent over a given period. Title the report "Income Statement" and list the name of the organization and the reference time period of the prospectus.

- For example, an income statement is often prepared for the period January 1st - December 31st of a particular year.

- Note that it is possible to prepare a balance sheet for a quarter or a month, while the income statement may refer to a full year. The financial statements will be easier to understand if the reference period of the income statement coincides, but this is not strictly necessary.

Step 2. List the sources of revenue

List the different sources of revenue and their amount.

- Be sure to report each revenue separately, adjusted as needed for any sales discounts or returns, for example: "Sales, $ 10,000" and "Sales Adjustments, $ 5,000".

- Organize the representation of revenue sources in a way that is meaningful to the company. For example, you can indicate revenue by geography, by agency, or by product.

- When all sources of revenue have been included, add them together and show the total as "Total Revenue".

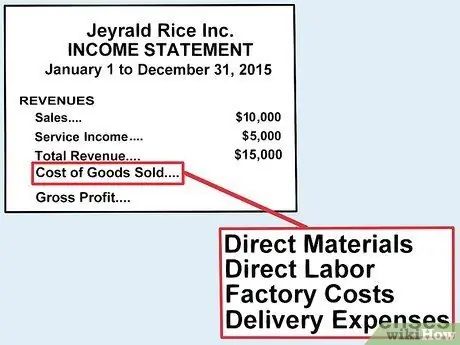

Step 3. Report the costs related to sales

This is the total cost of developing or manufacturing the product or providing the services over the reporting period.

- To calculate sales-related costs, you need to add the materials and labor used, factory costs, and shipping or delivery charges.

- Subtract the total sales costs from the total revenue and title the line "Gross Profits".

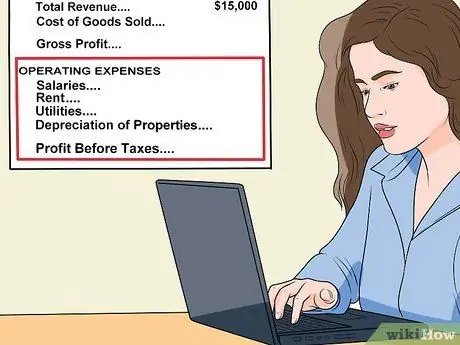

Step 4. Track operational costs

These include all those needed to run your business. For example, general and administrative expenses, such as salaries, rents, utilities and depreciation. They also include advertising and research and development costs. It is advisable to record these costs separately so that the reader of the report can get a rough idea of how and why the money was spent.

Subtract the sum of these costs from the gross profit and title the balance "Result before tax"

Step 5. Report profits from previous years

These indicate all profits and losses since the organization was formed.

By adding up the profits or losses of the previous years to the profit or loss of the current period, you get the amount of the profit or loss account carried forward

Part 4 of 4: Prepare the Cash Flow Statement

Step 1. Set up the cash flow page

This prospectus indicates the sources of cash with the relative amounts and their uses. Title this page "Cash Flow Statement" and add the name of the organization and the reference period of the document.

Similar to the income statement, this statement refers to a period - for example, January 1 - December 31

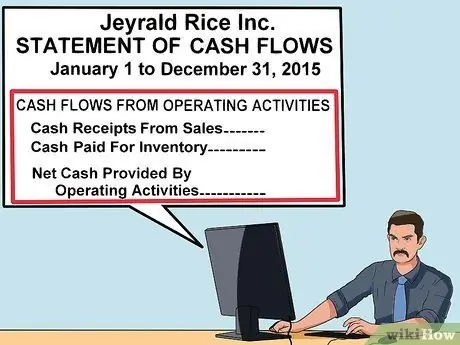

Step 2. Create a section for operational activities

The prospectus begins with a section which should be titled "Cash Flows from Operating Activities". This section is related to the income statement you have already prepared.

Lists the organization's operational activities. These can include items such as sales receipts and amounts paid for inventory. Make a running total of these items and title the resulting total "Net Cash from Operations"

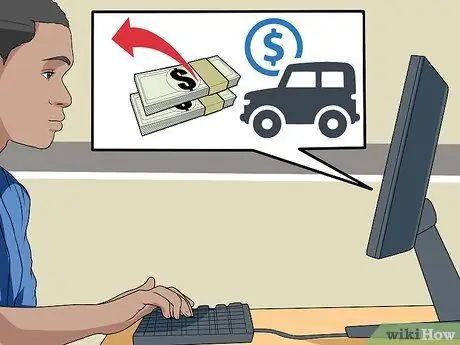

Step 3. Create a section for investment activities

Add a section titled "Cash Flows from Investing Activities". This section is related to the balance sheet you have already prepared.

- In fact, it concerns the cash that you have paid or collected from investments in real estate and equipment, or deriving from transactions for the purchase and sale of securities, such as stocks and bonds.

- Add a subtotal called "Net Cash from Investing Activities".

Step 4. Include financial assets

The last section of this page should be entitled "Cash Flows from Financial Assets". This section refers to the item securities in the balance sheet.

This section should show cash inflows and outflows from equity and debt securities issued by the organization. Add a subtotal called "Net cash flows from financial assets"

Step 5. Add the different categories

Add the results of the three sections in the statement of cash flows and title the total row "Cash Changes" over the period.

You can add the change (increase or decrease) in cash to the balance recorded at the beginning of the period. The resulting sum must be equal to the cash balance indicated in the balance sheet

Step 6. Add any important notes or comments

Financial statements often include a section called the "Explanatory Notes" which contains material information about the company. Consider what additional information about your organization's finances would be most helpful to include in this section, then add this information to your balance sheet.

- The notes may contain information on the history of the company, plans for the future or information on the business sector in which it operates. This is your chance to explain to investors what the financial statements mean and what they show or don't show. The note can help potential investors see the company through your eyes.

- Typically, the note also includes an illustration of the accounting policies, procedures used by the company, and explanations of the balance sheet items.

- This section also often includes details about the company's tax situation, retirement plans and stock options.

Advice

- Refer to generally accepted accounting principles for the preparation of accounting documents. The Accounting Principles represent the reference standard for accountants and financial professionals in all companies and sectors of activity.

- Remember to use clear descriptions for each balance sheet and income statement item. Financial statement information must also be readable by those who are not familiar with the specifics of the company.

- If you have trouble preparing your financial statements, look for one from a company that operates in your organization's industry. You can get some great insights into how to set it up. On the Internet sites you can find several models published for different companies.