The thought of filing a tax return can be a little troubling for most people, especially if you plan on preparing everything yourself. Organization is the key to streamlining the process. Collect all necessary information required in the tax settlement before you begin, including your W-2, bank statements with interest, tuition, property taxes, receipts and other applicable information, along with a copy of the tax return of the previous year. Now that you've got yourself organized and prepared for the task, you may find that filing your tax return is easier than you thought.

Steps

Method 1 of 3: Reporting Income Using an IRS Approved Preparation Program and Creating an E-File

Step 1. Purchase an affordable IRS-approved tax return preparation program and create an e-file

You can usually find them in some retail stores, stationery stores, or online. These programs typically indicate whether they are suitable for a personal tax return preparation, preparation for a business, or a combination of both. Reputable tax return preparation software you may consider include:

- TurboTax.

- H&R Block At Home.

- TaxAct.

- TaxSlayer.com.

- CompleteTax.

Step 2. Install or download the software to your computer

While you won't necessarily need an internet connection to use many of these programs, you may find that you need it if you want to report your income electronically.

Step 3. Open the tax return program and start filling it out with all applicable information

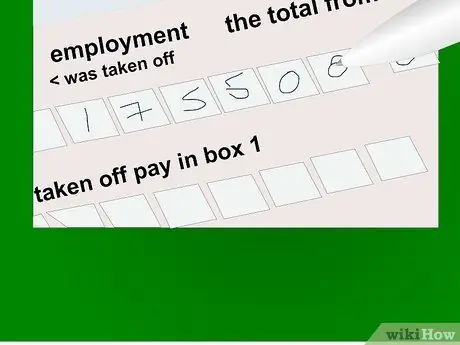

The software presents the taxpayer with specific information, helping to locate it on the filing documents, making it easier to prepare. During this process, the income preparation program will ask you about two main areas:

- Income. After all, it is called an "income tax return". Any money you've earned during the year, whether it's from a job, a freelance assignment, or the sale of assets, can qualify for income. Assets that you have liquidated, sold or inherited may also qualify for income.

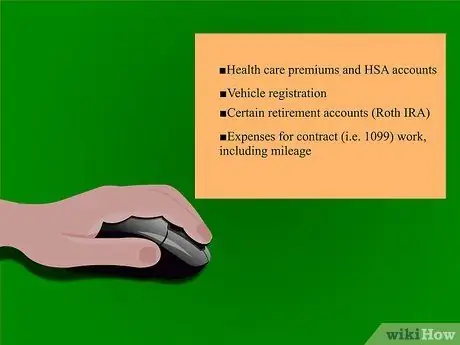

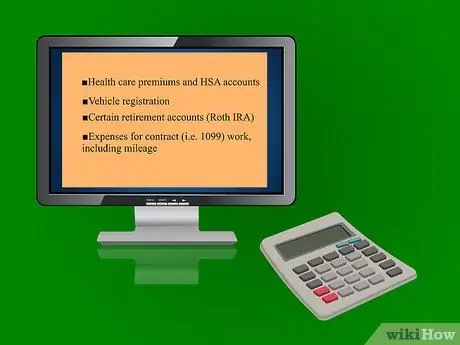

- Deductions. The government will let you deduct certain expenses from your taxes, provided they fall under certain parameters. Examples of deductions you could use when reporting income:

- Healthcare premiums and HSA accounts.

- Registration of a vehicle.

- Certain retirement plans (Roth IRA).

- Expenses for an independent employment contract (i.e. form 1099), including fuel consumption.

- There are many others, get informed about it.

- While the income doesn't necessarily have to be proven, the deductions do. You will need supporting documents, such as receipts, records, and / or pay slips to prove that your deductions are legitimate.

Step 4. Check for errors

Open the self-check tool included in the tax return program. If it finds errors or omissions, the software will guide you to make corrections. Use common sense when checking for mistakes. A simple typo or missing field on the form could drastically change what you owe when paying the taxes or refund you can expect to receive.

For example, if your calendar year income is $ 32,000 but your tax return preparation software indicates that you owe the government $ 8,000 in tax, you probably know there was a problem with the calculations. $ 8,000 in tax for an income of $ 32,000 means you're paying about 25% of your income in taxes, which is too high for your income bracket

Step 5. Restart the self-check tool to make sure you have made all corrections

Repeat this process until you have corrected all errors related to your tax status.

Step 6. Use the review meter included in the program before declaring income

This tool reviews your information to determine what your inspection risk is. If it is high, make sure the information you have on your tax return is 100% correct - a misleading sentence or number could be scrutinized and cost you if you were actually inspected.

Step 7. Declare taxes manually or electronically

You can do this in one of two ways: by mail or by selecting the e-file tool.

- Report by post: Submit your tax return to the address specified on your documents before the due date or on the same day. The shipping date is usually April 15th. If you owe money, you may have to declare your income and send what you owe to separate addresses.

- Declare electronically: Submit your documents on the internet before or on the day of the deadline. The software will guide you to enter your banking information. Carefully enter the name of your bank along with the account number to which the IRS should send any refunds or deductions of certain payments.

Step 8. If you can't meet the deadline, request an extension

You can apply for an extension either electronically or by post. If you decide to do so, the IRS will typically give you another six months to report your income.

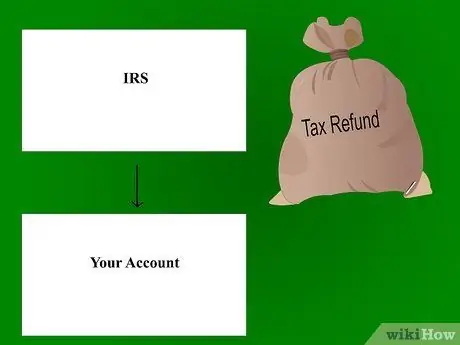

Step 9. Wait before you can receive any refunds sent by the government

If you have decided to report your income electronically, the IRS will typically automatically deposit any refunds into the designated account after four to eight days.

Method 2 of 3: Reporting Income Manually

Step 1. Understand that manually reporting income may increase your risk of making mistakes that will cost you dearly

The IRS is encouraging revenants to convert to electronic filing, or to use filing software, in part because it could save them money and avoid misleading errors in forms.

The IRS estimates that there is an error rate of approximately 20% in tax returns filed by hand, while those made with tax filing software only have an error rate of 1%. If you're worried about making mistakes on your tax return, it's best to opt for the tax return preparation program, which tells you about mistakes right away as you enter information

Step 2. Get a tax return package at your local library or post office

Due to the low demand for manual preparation, tax payers no longer receive packages in the mail. They can also download the necessary forms on the IRS website.

The package includes a full set of instructions and the forms needed to complete your state and federal tax returns

Step 3. Prepare your federal and state declaration according to the instructions

Fill in clearly by entering all relevant information on the required forms. It is best to use a black pen. Fill in the sections related to your income (job, contracts, asset or equity) and then move on to any deductions you can subtract from what you owe.

Step 4. Carefully review your tax returns, checking for mathematical errors and incorrect or missing information

You may want to hire a professional to review everything and notice possible errors. This will cost you a little more than completing everything independently, but it could help you see errors on your tax return, mistakes that could cost you money or have it inspected.

Step 5. Be sure to attach all supporting attachments provided in your tax return package with each tax return you make

On each page, remember to enter your social security number at the bottom, in the specified section.

Step 6. Make sure you sign and write the date on each tax return before mailing it

Step 7. Mail your tax returns

Before or on the day of the deadline, which is usually April 15, send your tax returns by registered mail.

- Address one envelope to the federal government and one to the state government using the addresses provided in your instructions. Your federal and state tax returns will go to two different places.

- Weigh each envelope with the declaration and any necessary documentation included and apply the correct number of stamps. Using the wrong amount of stamps could delay your refund.

Step 8. If you are unable to meet the submission deadline, apply for an extension

You can do this both electronically and by mail. If you decide to have an extension, the IRS will typically give you another six months to report your income.

Step 9. Wait to receive any government-issued refunds

If you decide to report your income with an e-file, the IRS will usually automatically deposit any refunds into the designated account after four to eight days.

Method 3 of 3: Hire Professionals to Prepare Your Tax Return

Step 1. Find an expert on your tax return and let her take care of it for you

Many individuals and businesses rely on certified public accountants, lawyers or national tax return preparation chains to fill out their documents.

Step 2. Provide your information to the professional

These may include copies of your W-2 (or other declaration forms), receipts, pay slips, etc. Make sure you give him a phone number where he can contact you in case he has questions or is missing data.

Step 3. Ask the secretary to make an appointment for you to pick up the complete statement and review it

Step 4. Meet the person who prepared the statements to review them

Sign and write the date on each of them.

Step 5. Determine how you want the practitioner to submit the statements

You can ask them to do this electronically or by post.

If you owe the government money, remember to put a check in your statement

Step 6. If you can't meet the expiration date, request an extension

You can do this both electronically and by mail. If you decide to apply for an extension, the IRS will generally give you another six months to report your income.

Step 7. Wait to receive any refunds sent by the government

If you have opted for e-file, the IRS will typically automatically deposit any refunds into the indicated account after four to eight days.

Advice

- Give yourself enough time to prepare, review, and submit statements. Always keep a copy of your tax returns for future ones.

- If you have any questions while preparing your tax return, talk to a professional. The official IRS website offers a support section that includes answers to frequently asked questions.

- Declare all your income and keep receipts, all supporting documents and detailed records to justify your deductions.

- If you choose e-file and use direct deposit, you can expect to receive your refund between eight and 15 days from the request. If you decide to wait for the paper check, the process takes longer, usually four weeks.

Warnings

- Never send tax returns without first checking them to see if the social security number is missing or if it is wrong, which will slow down the receipt of the refund.

- Don't send in a messed-up tax return and be sure to check for any math errors. You don't want to draw attention negatively, causing a closer scrutiny by the IRS or a potential inspection.