Keeping a family balance sheet is a great idea to put into practice, which will allow you to spend less, save more and avoid payment problems or paying excessive interest on credit cards. To create a family budget, it is sufficient to document current income and expenses as well as organize family financial discipline to regulate spending so that it proceeds on a solid financial basis.

Steps

Part 1 of 3: Setting up a Spreadsheet or Ledger

Step 1. Decide how to document family expenses, income and budget

You can just use pen and paper, but it's much easier to use a spreadsheet or a simple accounting program if you have it on your computer.

- At this link you can find an example of using spreadsheets for a budget.

- In a simple accounting program, such as Quicken, the calculations are practically automated, as these software are made for this type of project. These programs also have additional features that can come in handy for budgeting - such as savings tracking tools - however they are not free, so if you want to use them you have to invest a certain amount of money.

- Many spreadsheet programs come with a built-in model for calculating the family budget. Clearly they must be customized to meet the specific needs of the user, but these are better than starting from scratch.

- You could also use a dedicated program like Mint.com that can help you keep track of your expenses.

Step 2. Format the columns of the spreadsheet

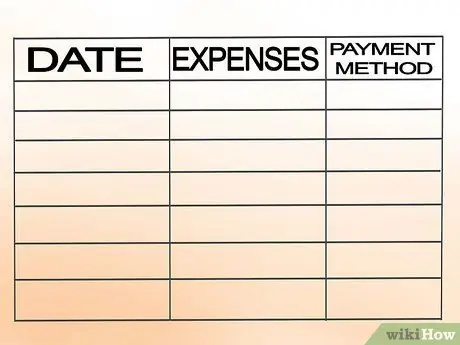

Assign a title to each column, for example "Date", "Spending amount", "Payment method" and "Fixed / discretionary expense".

- You must register all expenses and all income on a regular basis (daily or weekly). Many specific software and applications also have a mobile version that allows you to add expenses on the fly.

- The "Payment Method" column will help you record the type of expense you face. For example, if you pay by credit card to earn points at the grocery store, note that expense in this column.

Step 3. Break down your expenses into categories

Each item must go into a specific category, so that you can easily check the amounts on your monthly and annual bills as well as regular essential and discretionary expenses. This system will make it easier for you to enter the various expense items in the sheet and will allow you to search and find a specific item in a short time.

- Rent / Mortgage (including insurance).

- Bills - electricity, telephone, water, gas, etc.

- Maintenance costs - the garden or the maid.

- Transportation - automobile, fuel, public transportation, insurance.

- Food and other expenses (going out for dinner).

- Using a digital program to create the family budget has several advantages: it allows you to easily classify the type of expenditure (groceries, gas, bills, car insurance, etc.) and allows you to calculate the totals in different ways that are useful to understand what, when, where, how much and how (credit card, cash, etc.) you spend. The software also allows you to divide your spending according to different time periods and priorities.

- If you are using a paper ledger, it is recommended that you create a separate page for each of these categories, depending on how much you spend in each category each month. If you use software instead, you can easily add new lines to record additional expenses.

Part 2 of 3: Documenting Your Financial Situation

Step 1. Start by entering the largest regular expenses in your spreadsheet or ledger

Examples could be car payments, rent or mortgage, utilities (water, electricity, etc.), and insurance (medical, dental, etc.). Create a separate line for each expense. If your bill hasn't arrived yet, enter an estimated amount as a placeholder.

- Enter an assumed estimate of the recurring bills (based on how much you paid the previous year for that specific item), but when the actual bill arrives and you pay it, enter the actual amount in your ledger.

- Round up once and down once, in a range of 10 euros, to get an average estimate of how much you will spend on each item.

- Some companies allow you to pay an average annual fee, instead of having a bill that changes every month. Learn more about this to find the payment option that best suits your needs.

Step 2. Document your basic regular expenses

Try to remember all your basic regular expenses and what the amount of each is. How much do you spend a week on gas? How much is usually spent on food? Think of all the essentials you need, not the voluptuous ones. After adding a row for each of these charges, enter an estimate of the amount. When your bills and invoices arrive, however, enter the actual amounts immediately.

- Make your payments as usual, but whenever you take out your wallet to pay for something, keep the receipt or write down the amount of the expense. At the end of the day, calculate the total amount, on paper, on your computer or mobile phone. Be sure to note the various items of expense accurately and do not use generic terms such as "food" or "transport".

- Programs like Mint.com help you break down your expenses into categories like Food, Bills, and Miscellaneous Expenses. This can help you see how much you spend on each category per month.

Step 3. Record your discretionary expenses as well

These expenses include all those items that could even be done without and whose price is not commensurate with the degree of usefulness and satisfaction. They range from expensive dinners or evenings out, to breakfasts at the bar, to ready-to-go lunches.

Remember that each expense should have its own separate line. This can make your spreadsheet or ledger quite long at the end of the month, but if you've broken it down by spending it will be easier to manage

Step 4. Enter a line to note the savings

While not everyone can afford to save on a regular basis, everyone should aim for it and do so if possible.

- A great goal is to be able to save 10% of your paycheck, a percentage sufficient to grow your savings quickly enough, without compromising the quality and standard of living. We all know what it means to reach the end of the month and not have saved anything. That's why you need to save first. Don't wait until the end of the month to save some money.

- If necessary, adjust the size of your savings or, better yet, adjust your expenses, if possible! The money you have saved can be used later to make an investment or for other things you have in mind, like buying a house, college tuition, vacations, or whatever.

- Some banks offer savings programs for this purpose. It can be helpful in saving you a little something every month.

Step 5. Calculate all your expenses monthly

Add up each section of the spreadsheet separately, then calculate the grand total. This way you can see what percentage of your income went to each expense category, in addition to your total expenses.

Step 6. Record all your earnings and calculate the grand total

Include any kind of income, even those not billed (tips, chores, cash and tax-free money), money you found on the ground and your salary (or monthly balance if you get paid every two weeks).

- By salary we mean only the amount of your paycheck, not all income in a given period of time.

- Record all revenue from any source, with the same level of accuracy as you document expenses. Calculate your income on a weekly or monthly basis, as appropriate.

Step 7. Compare the totals of monthly income and expenses

If the amount of your total expenses is greater than your earnings, you may want to think about strategies to cut expenses or to reduce your bills.

- Having all the information related to every single expense you have made at your fingertips, as well as the degree of priority that each expense represents for you, it will be easier to identify expense items that you can eliminate or in any case reduce.

- If your monthly income is more than your total expenses, you should be able to put something aside. This money can be used for a mortgage, college tuition, or any other particularly expensive expense. Alternatively, you can use your savings for something less demanding like a trip to a spa.

Part 3 of 3: Create a New Budget

Step 1. Identify specific expense items on which you can make cuts

Establish a ceiling, in particular, for discretionary spending. Decide on a maximum amount that you cannot exceed monthly and try not to exceed!

- Budgeting for luxury spending is fine - you can't live without indulging in some fun. Respecting it, however, will allow you to keep them in check. For example, if you go to the cinema regularly, set a budget of € 50 per month to buy tickets. It means that once you've spent that amount, you'll have to wait until the next month to go see a movie.

- Essential expenses also need to be monitored carefully. Regular spending shouldn't absorb that much of your income. For example, food expenses should be at most five to fifteen percent of your household budget. If you spend more than that on food, you might want to cut back on your spending.

- Obviously, the percentage you spend can vary; for example, as far as food is concerned, it will vary according to prices, the number of members of your household and according to specific needs. The point of the matter is to simply make sure that you are not spending money unnecessarily. For example, why buy ready-made foods, usually more expensive, when you can prepare them at home and save money?

Step 2. Estimate and add contingent and emergency expenses to your budget

By including unexpected expenses, such as unexpected medical visits, house or car maintenance costs, in your budget, these expenses will have less impact on your overall budget and your financial strength.

- Estimate how much these contingent expenses could cost you in a year and divide the estimated total amount by 12, so that it fits into your monthly budget.

- This "buffer" sum means that if you just go over your weekly spending ceiling, it won't compromise your wallet too much and you won't have to worry about having to use your credit card.

- If you get to the end of the year without needing to use this emergency sum, that's better! You will have some extra money that you can channel into your savings or post-retirement investment plans.

Step 3. Calculate how much you can spend to reach your short, medium and long term goals

These are not emergency costs, but they are an integral part of your financial plan. Do you need to replace many elements of your home decor this year? Do you need a new pair of boots? Do you want to buy a car? Plan these expenses in advance and you won't need to tap into long-term savings.

- Another important point to highlight is that you should only plan for substantial purchases after you have collected the necessary savings. Consider if you really need them right now or if you can postpone your purchase.

- As soon as you use the money you have set aside for contingent or planned expenses, record the actual amount of expenditure and deduct it from the emergency budget you created, otherwise it will appear twice in your balance sheet.

Step 4. Create a new budget, combining the "buffer" amounts, financial goals, expenses and actual revenues

This exercise will not only help you create an effective budget by helping you save, but it will make your life a little less chaotic and more relaxed, while also motivating you to cut expenses so that you can achieve your goals and make all the purchases you want. without getting into debt.