Are you about to make a purchase but can't remember if you have enough credit available? Don't worry - there are several ways to access this information. Choosing the best method to check your card balance basically depends on two factors: the amount of information you are looking for and the means at your disposal. Not knowing what balance is available can be frustrating, but with one of these methods you can check it quickly and easily.

Steps

Method 1 of 3: Check your balance online

Step 1. Go online if possible

If you have internet access, your best option is to check your balance this way. Most credit card issuers offer an online banking service that allows you not only to view your balance, but also to make wire transfers or pay bills directly via the Internet. You can access from computer and smartphone.

Step 2. Visit the website of the credit card issuer or open the app on your smartphone

If you have a computer, you can simply go to the website (it should be indicated on the back of the card); if you have a smartphone, you can download the card manager app, if it has one; otherwise you will have to access the site through your phone browser.

Step 3. Create an online account if you don't already have one

If you've never activated your credit card issuer's home banking service, be prepared to provide identifying information, such as your full card number, date of birth, and billing address.

- You will need to choose a username and password. Think of something you can remember without having to write it down somewhere, but at the same time no one else can guess. You should use different usernames and passwords for each online account you have, so don't just recycle the ones you already use for another account.

- Many banking websites ask you to provide an email address. The credit card manager will send you an email with an activation link.

Step 4. Log into your online account

You will need to enter your username and password, whether you are using the app or the computer. Once logged in, click on "Balance and transactions". Here you can find everything you are looking for: your currently available balance, recent transactions and pending transactions that can affect your available credit.

- If you intend to make online payments you must provide information on the account to which they will be charged.

- Some online services also allow you to view old bank statements, so you can compare your credit card balances over time.

Method 2 of 3: Check Your Balance by Phone

Step 1. Find a phone

If you have access to a phone and are only interested in knowing your balance, calling your card customer service is your best bet.

- The advantage of calling is that you can speak to a live operator and request the information you need.

- The downside is that you may have to wait a long time before you can speak to an operator.

- Another downside is that if you have to ask more complex questions about past transactions and their effect on your balance, it may be difficult to follow up on the phone.

Step 2. Prepare the information you will need to provide

First, the customer service agent will need some personal data to verify your identity, such as your social security number, your date of birth or the answers to the security questions you have chosen (for example, your maiden name your mother's).

Secondly, make sure you have the card you are asking for information on hand - they may ask you for your card number

Step 3. Call the customer service number

You should find it on the back of the card. The vast majority of customer support services respond through a system that automatically communicates the balance or gives the possibility to listen to it before speaking to an operator.

Step 4. Identify yourself

If you are talking to a real person, they will ask you questions to verify your identity. If you are online with an automated service, you will need to enter answers to security questions via the telephone keypad.

Step 5. Request your card balance

An automatic system will guide you through the steps; most likely you will be asked to type numbers on the keyboard to indicate which options you choose. An operator will be able to tell you the balance and answer any other questions.

- You may have to go through several menus to get your balance information. The first menu may ask you to press a certain number depending on the account you want to access (for example, if you want to check your corporate credit card, you may need to press “2”). The next menu usually asks what kind of information you want about that account; in this case it will be the credit card balance.

- If, for any reason, it is not possible to access your balance information through the automated system, you can ask an operator for it; you can request to transfer the call to an operator by pressing the appropriate number indicated by the automatic menu.

Method 3 of 3: Check Your Statement

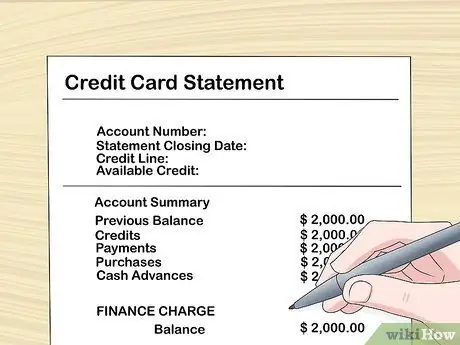

Step 1. Review your credit card statement

If you do not need to find out about fraud or dispute a transaction, the best way to get answers to questions regarding your transactions or pending transactions is to check your monthly statement.

Some people choose to receive their statements electronically. If this is the case, you will need to check your online account or email

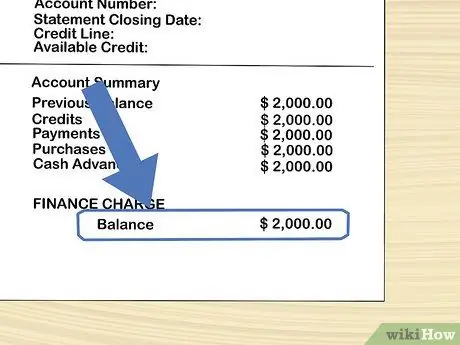

Step 2. Look for the balance on your bank statement

It should be in a well-marked, easily identifiable spot.

- You can also review the dates covered by your statement to see if you have made any additional purchases since the last reported date.

- The good thing about checking your credit card statement is that it allows you to review additional information, such as total availability or remaining credit.

Step 3. Add the total of purchases made since the end of the billing period

The statement you are holding may not include the most recent charges.

- If you don't remember if you have made any further purchases, it would be preferable to check your balance in another way.

- The disadvantage of checking the balance on your bank statement is that because about a month passes between bank statements, the reported transactions do not include the latest transactions.

- The statement also provides a variety of other information, including charges, default interest, and remaining credit available for cash withdrawals.

Warnings

Please note that however you access your balance information, any recently made purchases that have not yet been charged to your account will not be included in the reported balance

Advice

- A good way to avoid having to do last-minute checks on your balance is to keep a record of your credit card purchases between bank statements (you could use a “checkbook” style).

- If you want to check the balance of a prepaid credit card, the process should be very similar: look on the back of the card for the phone number or website through which information can be obtained.

- If you are so close to the maximum credit card usage limit that you need to do a last minute check on your balance, you have probably gone over 50% of your spending limit. While the specific figures may vary, experts recommend keeping your account balance below 30-50% of the credit limit on each card. Exceeding that threshold can reduce your creditworthiness.

- Keeping track of how much you spend is helpful in reminding yourself of the importance of living within your means and paying off your debts as soon as possible.