A budget can help you pay off an overdue debt, take charge of your financial future, and even become a more peaceful and relaxed person. Under the circumstances, an adequate budget will not necessarily force you to spend less. Instead, it may simply be that you need to make more forward-looking economic decisions.

Steps

Part 1 of 3: Recording Income and Expense

Step 1. Get everything you need to start calculating your expenses

Put aside bills, bank and credit card statements, old receipts and anything else that will allow you to make an accurate estimate of the amount of money you spend each month.

Step 2. You could use a program to help you set a budget

Personal finance software is becoming increasingly popular in this area. These programs incorporate tools that can help you customize your budget. They also offer statistics to help you estimate future cash flow and better understand your spending habits. Here are some of the most famous (some are in English, but using it is quite intuitive):

- Mint;

- Quicken;

- Microsoft Money;

- AceMoney;

- BudgetPulse.

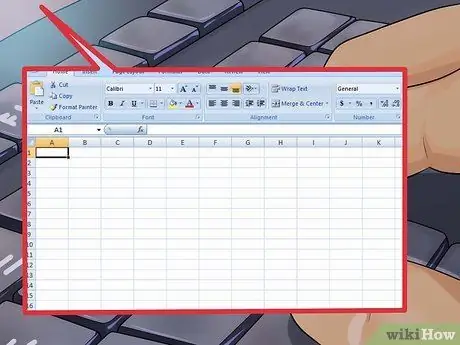

Step 3. Create a spreadsheet

If you prefer not to use specific software, you can calculate the budget with a simple spreadsheet. Your goal is to record all your income and expenses over the course of a year, so create a spreadsheet that clearly demonstrates all the information, allowing you to quickly identify areas where you can spend smarter.

- Label the first row of horizontal cells (starting at B1) with the 12 months of the year.

- Dedicate column A to expenses and income. You decide which ones to list first, but try to group your receipts and expenses separately to avoid confusion.

- You can try to group expenses by category, with relative title. For example, you may have a category called "Bills" which groups together electricity, gas, water and telephone bills.

- Decide whether to include expenses that are deducted directly from your paycheck, such as insurance, pension contributions, or taxes. If you don't include them in your spreadsheet, be sure to indicate your net salary (i.e. the amount that remains after calculating the deductions) instead of the gross salary (the total before calculating the withholdings) under the income section.

Step 4. Document historical data for the past 12 months

Enter all expenses and income from the last year. Use the data you find on your bank and credit card statements to get an accurate representation of all your income and expenses.

Step 5. Determine your overall monthly earnings

Do you earn a fixed salary and do you know for sure what your weekly income is? Are you a freelancer and your salary changes every month? Recording a year's financial transactions can help you get an accurate overview of your monthly income on average.

- If you are self-employed or freelancer, keep in mind that the proceeds are not the same as what you actually earn. For example, if you collect 2,500 euros each month, remember that this figure is not net. Try to make a rough calculation of the taxes you should pay and subtract this from your monthly income to get a more accurate figure.

- If you work as an employee and receive a fixed salary, do not include a possible tax refund in your general income. Monthly income should only reflect what you earn after deducting taxes. If you then receive a refund, you can do whatever you want with it; if not, you won't have to worry about it.

Step 6. List all monthly expenses in the spreadsheet

What bills do you have to pay each month? How much do you spend on shopping or gas every week? Do you go out for dinner with your friends every Friday night or to the movies once a week? How much money do you spend on shopping? Recording your actual spending for a year will help you get a more accurate overview of your spending habits. In fact, most people underestimate the amount of money they think they're spending each month.

Step 7. Analyze your income and expenses

If the expenses exceed the income, you are living above your means. The budget should be divided into two groups:

- Fixed Expenses: These include regular monthly expenses, such as utility bills, insurance, loans, food, and shopping to buy basic necessities, such as clothes and household goods.

- Discretionary Charges: These charges are not fixed, but optional. Here are some releases that fall under this category: savings, entertainment, vacation funds, and other luxuries.

Part 2 of 3: Create the Budget

Step 1. Create a preliminary budget

The analysis done in the first part of the article will help you to make an accurate preliminary budget. You should calculate your fixed income and expenses, then decide how you want to spend the discretionary money.

- To calculate your fixed expenses, take the total for the past year and divide it by 12 to get a monthly average. Then, add about 5%. For example, if your electricity bill changes seasonally but the average is € 210 per month, you should calculate a monthly bill of € 220.

- Be sure to consider changes affecting fixed expenses; for example, perhaps you have paid off a debt, but in the meantime the installments of the new car have been added.

Step 2. Set goals based on the amount of extra money

Now that you've determined the amount of money you should have each month, decide how you want to spend it. Your purpose should be clear, explicit, and doable. Here are some possible short-term goals:

- Save € 8,000 for an emergency savings fund.

- Deposit 5% of each paycheck into a savings account.

- Pay off the debt that the credit card has generated in the last 12 months.

- Save 6,000 euros for a special holiday.

Step 3. Maximize your tax benefits

There are ways of saving that can offer tax benefits. If you decide to save for a supplementary pension, which is complementary to the compulsory public pension, the state offers tax concessions regarding the payment of contributions and the return on money. Learn about the different plans offered by insurance companies.

Step 4. Decide how to use the extra money you have left

In this case, you simply need to locate your values. What do you believe in and how do you want to spend your money to make it happen? After all, money is a means to an end, not an end in itself.

- What kind of person are you and what do you like to do? Many decide to spend their money on hobbies, interests, or causes they believe in. Think of it this way: it's an opportunity to invest in a satisfying experience or feeling.

- Think about what makes you really happy. According to a fairly common theory, people who spend more on non-material pleasurable experiences are actually more peaceful than those who spend on possessions.

- You could save some money for a trip and vacation.

Part 3 of 3: Becoming a Real Expert

Step 1. Keep your budget and don't spend more than you need to

It is the first rule for planning expenses, and more or less the only one. It will seem obvious, but it is easy to exceed the maximum, even after having established one. You need to be aware of your spending habits and where the money goes.

Step 2. Try to reduce your expenses

Limiting larger expenses can be the most unpleasant but most effective way to stick to a budget. If you take a vacation every summer, you may be staying at home this year. Even the smallest expenses can pile up.

- Try to identify and reduce all the luxuries you allow yourself. If you like to treat yourself to a massage a week or have a strong predilection for expensive wines, limit the frequency with which you indulge yourself, so that you only spend money on it once a month or every two months.

- Save on smaller expenses by preferring generic brands and eating at home more often. Try not to eat out more than once or twice a week.

- Find out if you can reduce some fixed expenses by switching to a less expensive mobile plan, choosing a less expensive TV package, or improving the energy efficiency of your home.

Step 3. Indulge in a treat from time to time, but in a reasonable way

You use the money, it is not the money that uses you. You don't have to feel like a slave to budget or money in general, so it's important to treat yourself to a small bonus once a month, as long as it doesn't cause economic imbalances.

Do not abuse this incentive system to the point of making it counterproductive and causing economic imbalances. The idea is to give yourself small and cheap rewards, like a cappuccino at the bar or a new shirt. Avoid wasting money on more expensive products or services, such as a vacation or a pair of designer shoes

Step 4. Pay off your credit card bill every month

If you use credit cards, you should try to keep a monthly budget of zero to avoid excessive costs. When you can't pay your current debt, put it first. Try to pay it off in a reasonable time so that you don't have any debt.

Try to pay cash for most weekly purchases, especially extras like eating out or cappuccinos at the bar. This can help you control your spending, because you are generally more aware of money spent on cash than money deducted from a credit card

Step 5. Reduce your taxes

When filing your annual tax return, try to make the most of your tax deductions.

- Start keeping receipts, especially if you are self-employed and work from home or remotely. When preparing your tax return, there are many services that can be related to the profession.

- If you are self-employed, you may want to do some research for a larger tax refund. You can also ask the accountant how to do it.

Step 6. Recover the investments made for your home

If you have invested in renovating or optimizing the energy efficiency of your property, it is possible to deduct part of the expense from the tax return, provided that you have kept complete documentation. Ask an accountant to find out more. You can also request a real estate appraisal to estimate the value of the property, then try to downgrade it and pay less tax on it.

Step 7. Don't count on lucky breaks

Do not calculate potential (uncertain) sources of income, such as year-end bonuses, inheritances, or tax refunds. In the budget you must include only the money that you will surely earn.

Advice

- Store the loose change in a jar and then take it to the bank to deposit. You will be surprised by the nest egg that you will be able to obtain in this way: even the coins make a difference.

- Avoid getting into debt with revolving credit cards and payday loans, as they involve high interest rates and end up taking a lot of money away. You should avoid them especially if you are already having trouble paying your bills on time every month.