Knowing how to calculate daily interest is very useful both for determining the amount of interest earned and for determining the total amount to pay. Business applications for financial and administrative management include a function for calculating interest on overdue and unpaid payments relating to customers or suppliers. Being able to calculate the amount of interest as part of your financial management will allow you to estimate the total amount necessary to pay off a mortgage or to evaluate multiple options relating to a savings or investment plan. This guide shows several ways to calculate daily interest.

Steps

Method 1 of 3: Using a Computer

Step 1. Get all the information you need to proceed

You will need to know the total amount of money you wish to invest or have planned to set aside, the duration of the operation and the proposed interest rate. If you are going to compare multiple alternatives, you may need to manage several variables.

In order to correctly compare the options available to you, you will need to set up calculations for each of them

Step 2. Launch the spreadsheet installed on your computer

This kind of application will be of great help in calculating interest. Proceed to insert the data listed in the first step into the cells of the worksheet. At this point set the formulas to perform the calculations. Once the formulas are in place, you will be able to evaluate the alternatives available to you with ease and immediacy.

- Some of the popular programs include Microsoft Excel and iWork Numbers.

- There are also free online spreadsheets, such as Google Docs or Zoho Sheet.

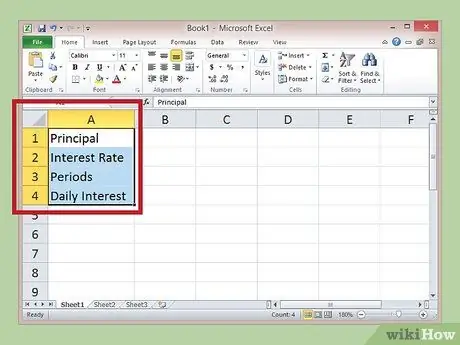

Step 3. Enter the descriptions inside rows 1-4 of column A

Within the cells in question enter the following descriptions: Capital, Interest rate, Duration and Daily interest. You can enlarge the cells by selecting and dragging the right separator of the header of each column (the mouse pointer will turn into a pair of opposite arrows). These descriptions will only serve you, as a reference for the data entered.

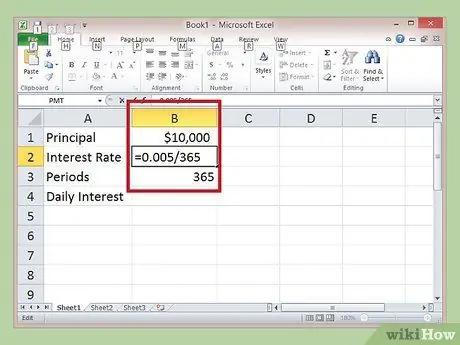

Step 4. Enter your transaction data in column B

Use lines 1-3 so that their cells coincide with those reserved for descriptions. Convert the interest rate into a decimal number by dividing it by 100. For the moment, do not enter any data in cell B4, which is the one reserved for calculating the daily interest.

- Normally the interest rate refers to the whole year, therefore, in order to calculate the daily one, it is necessary to divide the annual rate by 365.

- For example, if your capital to invest is € 10,000 and your savings account offers you an interest rate of 0.5%, you will need to fill in the spreadsheet as follows: "10000" in cell B1 and "= 0, 005 / 365 "in cell B2 (both data must be entered without quotation marks).

- The duration of the investment determines the period of time during which your capital will remain fixed and therefore unchanged, with the exception of compound interest that will be added at each maturity. As an example you can use a time interval of one year, which will be entered in cell B3 expressed as "365" days.

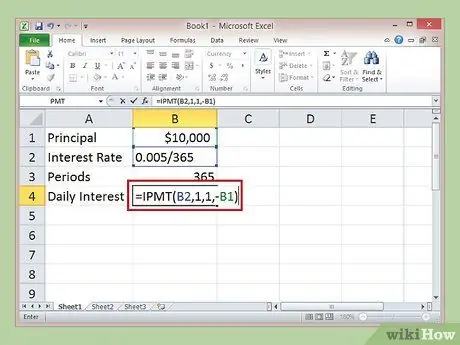

Step 5. Create the formula to be entered in cell B4 to calculate the annual interest expressed as a daily amount

Functions are special formulas provided by spreadsheets to make it easier to perform complex calculations. First click inside cell B4 to select it, then click the appropriate bar to enter the formula.

- Enter the formula "= INTEREST (B2, 1, 1, -B1)" (without quotes) inside the typing bar. When finished, press the "Enter" key.

- The daily interest generated by the deposit account in our example, relative to the first month, is equal to € 0.1370 per day.

Method 2 of 3: Calculate Daily Interest Manually

Step 1. Get all the information you need to proceed

You will need to know the total amount of money you wish to invest or have planned to set aside, the duration of the operation and the proposed interest rate. If you are going to compare multiple alternatives, you may need to manage several variables.

Step 2. Convert the interest rate percentage to a decimal number

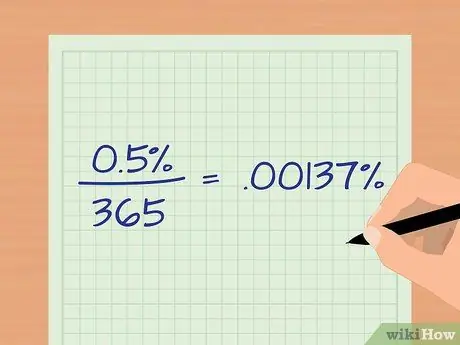

To do this, divide the interest rate by 100, then divide the number obtained by 365, that is, by the numbers that make up a year. This way you will get the daily interest rate and you can use it within the formula.

An annual interest rate of 0.5% or 0.005, divided by 365, will result in 0.00137% or 0.0000137

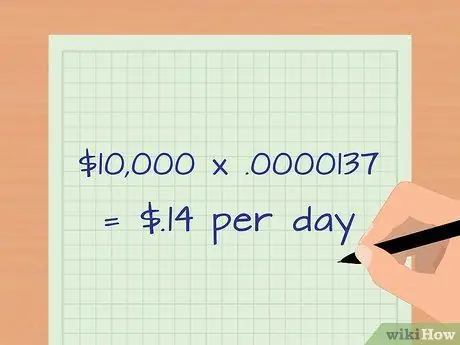

Step 3. Multiply the principal amount by the daily interest rate

If the capital of your investment is equal to € 10,000, multiplying it by 0, 0000137, you will get as a result € 0, 1370. By rounding the number obtained in our example, we will know that the capital in question generates a daily profit of € 0.14.

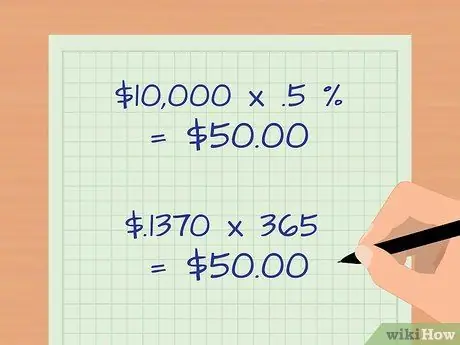

Step 4. Check the accuracy of your calculations

Calculate the interest amount: multiply the initial capital, € 10,000, by the annual interest rate, 0.5% or 0.005. You will get € 50 as a result. To find out if your calculations are correct, multiply the amount of interest generated daily: € 0.1370 by 365 days. Also in this case the final result is 50 €.

Method 3 of 3: Calculate the Daily Compound Interest

Step 1. Get the information you need

Unless you decide to take advantage of the amount generated by interest, it will be automatically added to the initial capital of the investment, generating a profit in turn. To calculate this, given you need to know the amount of capital to invest, the annual interest rate, the annual maturities in which to calculate the compound interest (in our case 365) and the number of years relating to the duration of the investment.

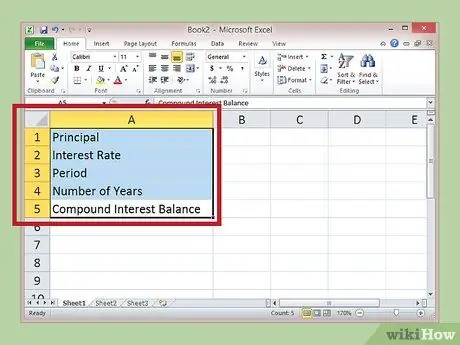

Step 2. Start your favorite spreadsheet, for example Microsoft Excel

Enter the descriptions of the data in rows 1-5 of column A. Inside the cells in question enter respectively: Investment capital, Interest rate, Number of annual maturities for calculating interest, Duration in Years and Amount Compound interest. You can enlarge the cells by selecting and dragging the right separator of each column header (the mouse pointer will turn into a pair of opposite arrows). These descriptions will serve exclusively to you, as a reference for the data entered.

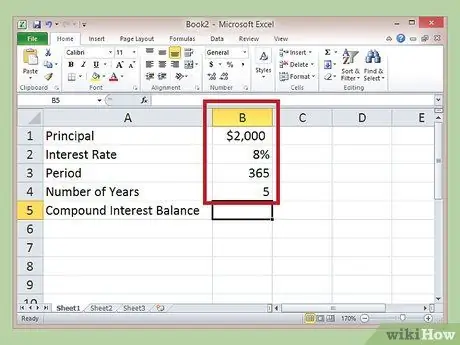

Step 3. Enter your transaction data in column B

Use rows 1-4 so that their cells coincide with those reserved for descriptions. The period to be calculated is 365 days (since we want to calculate the daily compound interest), while the number of years corresponds to the duration of your investment. For the moment, do not enter any data in cell B5 (relating to the compound interest amount).

For example: Investment capital = € 2,000, Interest rate = 8% or 0, 8, period for calculating compound interest = 365 and Duration in years = 5

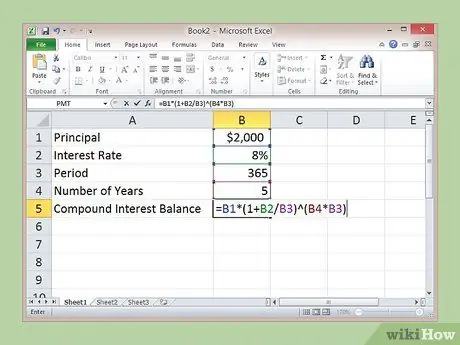

Step 4. Click inside cell B5 to select it, then click the input bar to be able to enter the following formula:

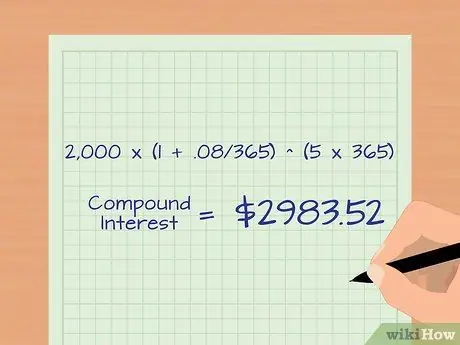

"B1 * (1 + B2 / B3) ^ (B4 * B3)", then press the "Enter" key. After 5 years, the compound interest of your investment led you to have a final capital of € 2,983.52. Calculations in hand, you can see that the reinvestment of the interest earned is an excellent form of investment.

Step 5. Calculate compound interest manually

The formula to be used for the calculation is the following: Initial capital * (1 + Annual interest rate / Number of annual maturities for calculating interest) ^ (Duration in years * Number of annual maturities for calculating interest). The ^ symbol indicates exponentiation.

For example, using the same data listed in step 3, Starting Capital = € 2,000, Interest Rate = 8% or 0.08, Interest Calculation Period = 365 and Duration in Years = 5, we will get the following: Interest compound = 2.000 * (1 + 0, 08/365) ^ (5 * 365) = 2.983.52 €

Advice

- To determine the daily interest rate applied to a mortgage or mortgage, you can use Excel's "Interest" function. Having sold your home in the middle of the month, the final amount to be paid will vary every day. The daily interest amount will tell you the exact amount to pay.

- You can also use Excel's "Interest" function to determine the daily interest rate for overdue and unpaid payments from your customers.